We're in a Bear Market (Playbook)

Explaining my rationale for this title as well as introducing ways to hedge.

“People get smarter but they don’t get wiser. They don’t get more emotionally stable. All the conditions for extreme overvaluation or undervaluation absolutely exist, the way they did 50 years ago. You can teach all you want to the people, you can tell them to read Ben Graham’s book, you can send them to graduate school, but when they’re scared, they’re scared.”

— Warren Buffett, on why most investors fail

Well, it’s official.

After the fastest V-shaped recovery in history, the stock market (in my humble opinion) is officially in a bear market. Over the last 3 weeks the Dow Jones Industrial Average has declined by -7%, the S&P 500 has declined by -9%, and the Nasdaq has declined by -13%.

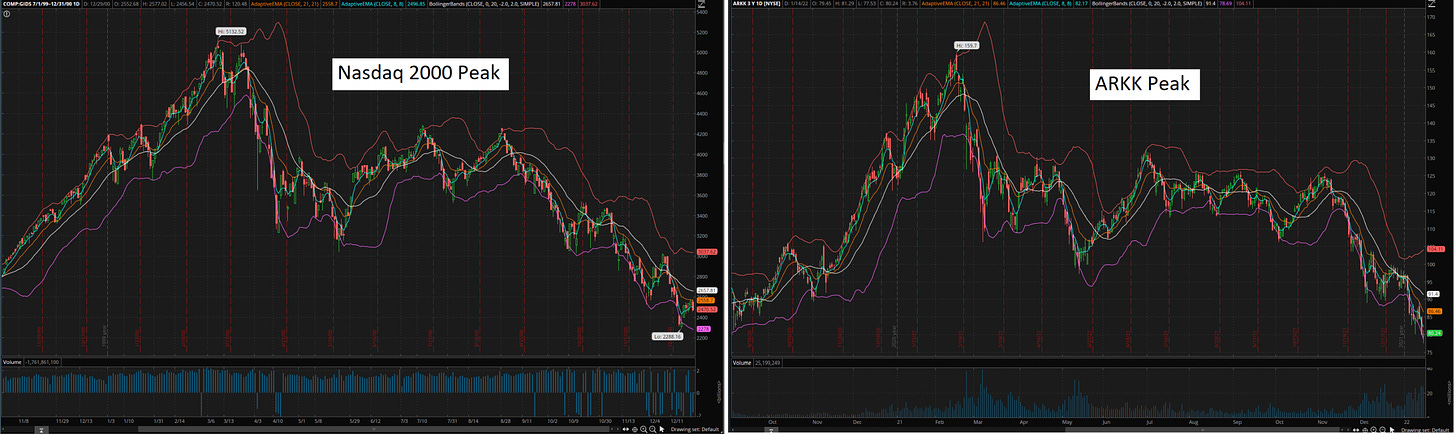

Among the most glaring “yikes” is the terrible performance of Cathie Wood’s ARKK ETF — an ETF that tracks the high-octane growth stocks. ARKK has declined -54% since hitting an all-time high in February.

In this post, we’ll cover:

How we got here

How I’m navigating this bear market

How to think about this from a ‘wealth building’ perspective

How We Got Here

If you joined my Twitter Spaces with Sylvia Jablonski (CIO of Defiance) and Chris Sommers (CEO of Unhedged) from the other week, you might remember my play-by-play explanation of exactly how the market reached new all-time highs. Here’s a transcript from the recorded discussion:

“Let’s rewind almost 2 years ago now to when the pandemic first began in March of 2020. The Federal Reserve lowered interest rates down to zero percent and launched a massive $700 billion dollar quantitative easing program. By lowering interest rates, the Fed was doing their part in trying to encourage consumers to borrow more money — therefore spending more money.

As you all remember, no one was really spending. No spending = businesses don’t make money = can’t pay employees = a terrible economy. So by lowering interest rates they were pretty much saying ‘go take out debt and spend spend spend!’

So how did they go about lowering the rates? Through open market operations, when the Fed begins spending billions and billions of dollars buying bonds, they are able to lower rates.

With lower interest rates, corporations could borrow more cheaply, people were spending more money… increasing the revenue for these businesses dramatically which in turn drove higher their FCF and valuations. The result? The stock market is having a grand ole time again.”

A few other catalysts for how we got to these sky-high valuations:

Record number of SPACs created — SPAK ETF

Retail / meme stocks — MEME ETF

Insane IPO price pops upon trading driven by retail demand (ABNB, SNOW)

Work from home / digital secular growth trends driving valuations higher

Let me be very clear — there are countless companies who have hit the public markets over the last 2 years who will outperform over a 5-7 year period of time. There are countless companies who are trading for pennies on the dollar now because investor sentiment is trending lower.

I do not want to discount the validity of a company like Coinbase, Airbnb, or Upstart just because their stocks have fallen -46%, -24%, or -75% respectively throughout the last year.

If you need some help seeing these stocks as actual businesses, read my post below.

However, I will discount the validity of pre-revenue companies like QuantumScape (QS) who hit the market — then 10X’ed in price in only 2 months. Another terrible example of this was the pre-revenue scam Nikola Motors (NKLA). Embarrassed I fell for that one, even though I made out like a bandit.

I want to bring light to a fantastic summation of a the current macro environment published by my friend Kyla Scanlon here — uncertainty.

I’m not sure if you remember me saying this, but I certainly try to mention this word here and there when describing a company’s revenue if it’s applicable — and that word is predictable.

Investors love consistent and predictable revenue. Which means the companies with predictable revenue will be able to withstand a broader market sell-off better than those without it. Think about Proctor & Gamble, a company I covered in the most recent Week in Review — they sell laundry detergent, paper towels, tooth brushes, diapers, and other essential products.

They’ve been increasing their revenue by mid-single digits every year since 2016 and will likely continue on this trend through 2026. From the perspective of an investor, that’s reassuring and feels good to know — I’d assign value to that.

Which is exactly what the market has done — PG stock is down only -0.5% YTD while the S&P 500 is down -7.8% YTD.

Uncertainty = a sell off.

Extreme uncertainty (pre-revenue, pre-FCF, pre-profits, etc.) = a massive sell off.

An example of extreme uncertainty is what has been happening with Affirm’s stock price. The company operates in a completely new business called “Buy Now Pay Later,” they’ve received a few reports citing uncertainty with customers paying back the borrowed amounts, and most importantly they’re not exactly profitable or even FCF positive.

Affirm’s stock has sold off -43% YTD. Investors want nothing to do with a company with this much uncertainty.

It seems like investors’ risk appetite peaked in February across these “new” growth stocks — as seen with ARKK’s price action.

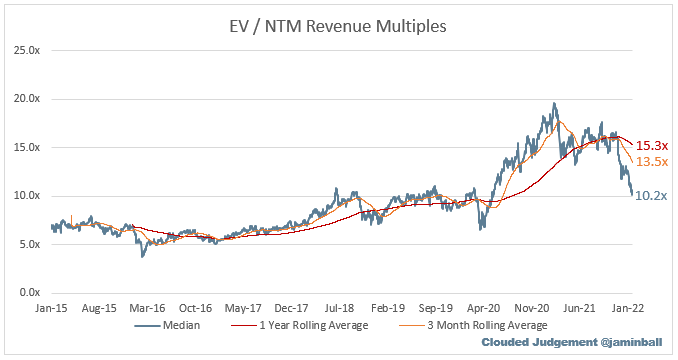

And as seen by Jamin Ball’s (Clouded Judgement) chart below, we still have a ways to go until valuations are back to “pre-COVID” levels. For me, the main question remains..

Should we be trading back at or below pre-COVID levels?

Well, the answer is yes and no.

How I’m Navigating this Bear Market

The chart below tells an incredible story that we all need to completely understand to be successful over the coming 3-5 years in the market. This image illustrates the upmost importance that valuation multiples have as key drivers of stock prices over a long period of time.

In the short-term, the valuation multiples that are naturally occurring in the stock market have a massive impact on a company’s stock price upon IPO and into the first 12-24 months of trading — accounting for 46% of movement.

But as you can see, over 3, 5, and 10 year time periods the naturally occurring valuation multiples in the market have less and less of an impact on a company’s stock price. Instead, it’s their financial performance that drives the stock price up and down.

Right now, the naturally occurring valuation multiples (shown above courtesy of Clouded Judgement) are what’s moving the stock prices of these high-octane growth stocks we’ve covered closely around here — Upstart, Airbnb, Coinbase, Asana, etc.

They’re compressing as the Fed raises interest rates — exactly why this happens is explained by Chris Sommers during the Twitter Spaces linked here. Long story short, higher interest rates = higher cost of capital. Here’s a link from the Balance that explains everything very well.

All of these companies are still on their first “bar” — where current macro valuation multiples have a 46% correlation to the company’s stock price. An obvious place to see this in action is ARKK’s price. The majority of companies in this ETF find themselves on the first and second “bar” above.

As shown below, similar to the macroeconomic bubble of 1999 / 2000 — ARKK has performed quite the same (compressing multiples) and we all know how that ended. I believe there’s exceptionally more downside for some of these companies in the coming 6-12 months.

Which begs the question — how do we take advantage of this?

There are several ways folks like to track investor sentiment. Click here for a further explanation of what I’m talking about. Below is a sentiment indicator used by analysts on Wall Street that essentially compiles the combination of trading volume, volatility, and other factors to a line on a chart.

As the markets move lower, we see a lower line on the chart, and as of right now we’re at the lowest level of investor sentiment since the COVID crash in 2020. Looking back throughout the last 15 years we can see the market “bottoms” around the time sentiment hits 30-35.

Once this happens, according to the image below, the odds that the S&P 500 will be trading higher than it was when sentiment was between 30-35 is roughly ~89%. Simply put, when you buy into the S&P 500 when sentiment is 30-35, there’s an ~89% chance you’ll be in the green at the end of 52 weeks.

This means (theoretically of course) within 52 weeks, there’s an 89% chance naturally occurring valuation multiples will rise throughout the markets — conveniently putting some of our favorite names (COIN, UPST, ABNB, AFRM, ASAN, etc) around that 3-5 year time range. Allowing for their stock prices to not only be boosted by macroeconomic multiple expansion but also their own financial performance.

My goal in the coming 6-12 months (I have no idea how long this bear market will last nor do I know how low we’ll go) is to absolutely pile into both our favorite names and the indices they operate within (Nasdaq Composite) once I believe we’ve “bottomed” according to the sentiment chart above.

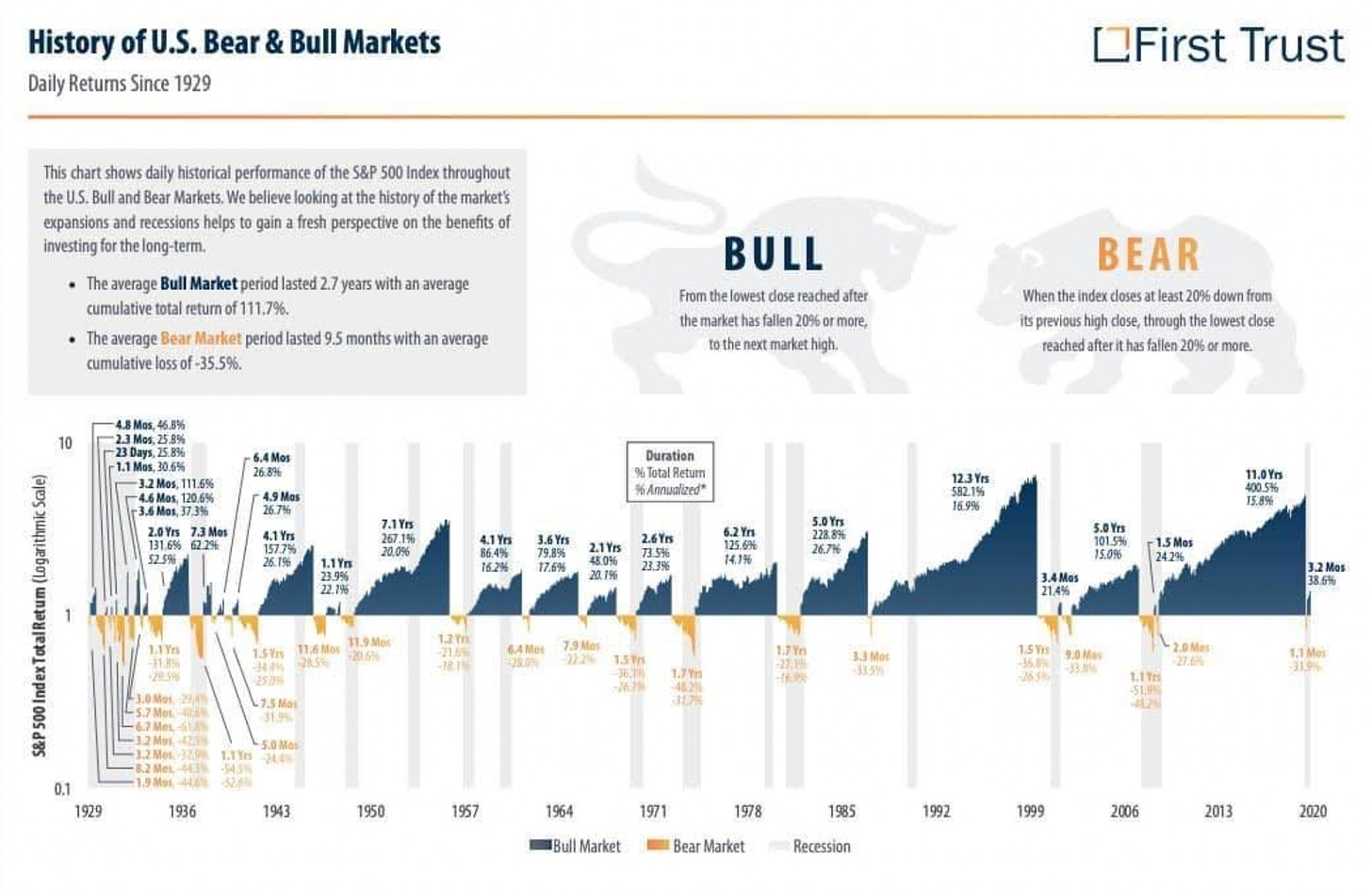

According to the chart below, bear markets last on average ~9 months reflecting -35% drawdowns from recent all-time highs. Right now, we’re ahead of schedule with the S&P 500 down nearly -8% in only 1 month.

For the coming several months I’ll be building a cash position / sprinkling in on whom I believe is trading for pennies on the dollars (AFRM, COIN) in relation to where they will be in 3-5 years.

How to Think About This From a ‘Wealth Building’ Perspective

I want to share a video with you my friend Mikey Taylor recently shared on TikTok — watch it here.

Long story short, he details a scenario in which 5 people invest $2,000 per year into the S&P 500 in 5 different ways..

One person times the market perfectly, investing the $2K at the “bottom” every single year

One person invests immediately upon receiving the $2K — no rhyme or reason

One person invests $166.66 every single month (dollar cost averaging)

One person times the market horribly, investing the $2K at the “top” every single year

One person never invests and instead parks their money into treasury bills yielding a percentage point in interest per year — like a savings account

Let’s be practical — the first scenario is impossible and no one in the history of the world has ever been able to time the market bottom every single year for 20 years in a row. The second scenario sounds like most folks — get the money, invest it, forget about it. The third is also something many investors do and is what I personally do for my retirement. The fourth scenario is a nightmare, and chances are no one is buying the absolute “top” of the market every single year for 20 years. The fifth scenario is the unfortunate reality for a lot of people waiting for that “perfect” opportunity.

Here are the balances of everyone’s accounts at the end of 20 years:

$151,391

$135,471

$134,856

$121,171

44,438

Assuming you’re the world’s best investor buying the “bottom” of the market every single year for 20 years in a row you’ll only return +12% more than someone who simply dollar cost averaged every month.

If you find yourself buying the market “top” every single year for 20 years in a row you’ll return only -10% less than someone who dollar cost averaged every month.

What I’m trying to say is that this bear market isn’t going to ruin any sort of long-term foundation you’ve likely been building for yourself. Markets move up and down. Some years we buy the bottom and some years we buy the top — but over the long term this doesn’t have a material impact on the amount of money we’ll have as we head into retirement.

If you found yourself loading the boat in October 2021 when the market peaked and you’re now feeling horrible about it — don’t sweat it. It’ll seem like a silly thing to have worried about in 20 years.

If you’re a crypto investor, I’ll also be posting some tips tomorrow to take advantage of the decline and improve your tax bill.

Yes — I’m trying to strategically time the market using sentiment indicators, moving averages, macroeconomic data, and Wall Street analyst reports in hopes of having my investments go further during the upside recovery.

As I’ve said before, I dollar cost average into my Roth IRA every month — putting my retirement fund in the bucket as the ‘third person’ above. On the other hand — I think trying to find the “perfect time” to load the boat on my highest conviction names is fun and worth trying to do. Especially if I can bring you all along for the ride.

As it relates to “safe” places to park your money while we watch the markets potentially move another -15% to -25% lower you have the following options:

SPHD — S&P 500 low volatility high dividend yield ETF, flat YTD

SPLV — S&P 500 lowest volatility stocks, down “only” -5% YTD

LDSF — ETF to act as “cash” paying a dividend monthly, 2% annual yield

Real Estate — I use Fundrise and have had zero problems. Here’s a comprehensive breakdown of their 2021 investment strategy and returns

You have a few choices here — continue to dollar cost average and ride the wave, load the boat on your highest conviction plays when the time is right, or a mix of both. Regardless, we’re playing the long game and the data shows us we’ll win in the end.

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Easy to lose sight of what we're building for our future when turmoil in markets hit. This is a great reminder to not sweat bear markets. Money can be made in any market for the most part as long as you do your due diligence. Appreciate the post, Austin!