👉 The Investing Week Ahead: 9/18/23

A "glitch" with some of the most important data in the world... ?

Welcome to your new week.

Ladies and gentlemen — sentiment could be turning negative in the market.

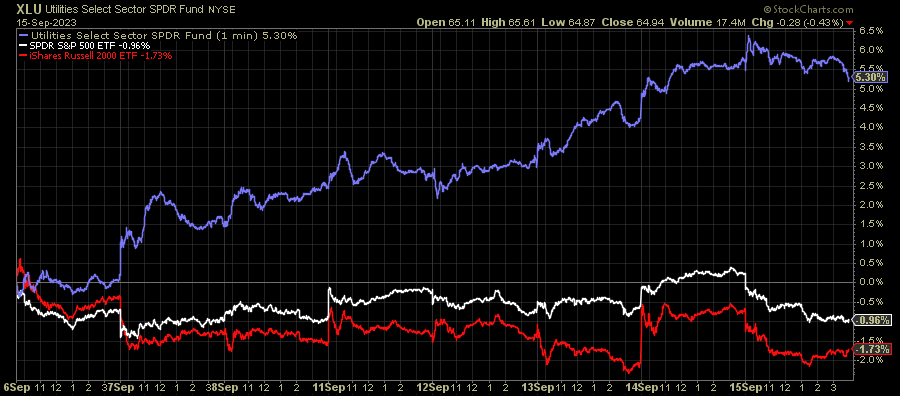

Over the past week, Utilities have definitively outperformed the S&P 500 and the Russell 2000.

What does this mean?

Utilities is a defensive sector — so a notable diversion compared to the rest of the market could indicate that ‘smart money’ has already gone into protection mode.

👉 Investment Idea During These Questionable Times — Farmland

We talk about new investment ideas over here all of the time: real estate, fine wine, startups, and many others. However, this idea is probably my favorite simply because of the historical returns and the physicality of it.

Investing into Farmland — why people do it, how they make money, and where it might fit inside of your portfolio.

Investing in farmland has slowly become more and more popular as investors continually look for more ways to diversify their portfolios.

You might remember this TikTok video I shared earlier this year highlighting Joe Burrow and other professional athletes' recent $5M investment in a 104-acre corn and soy-focused farm in northern Iowa with the goal of leasing the land to farmers.

Investing in farmland can take many shapes — that might mean soybeans, citrus, or even timber. But the rationale behind the investment is always the same — potential capital appreciation and passive income.

Over time, the farmland itself appreciates in value (similar to any form of real estate).

This is usually 2-3% per year in appreciation. Also similar to other forms of real estate, passive income can be generated for the investor by leasing the land to farmers. Sort of like renting a house to a tenant.

The AcreTrader team is deeply experienced in all things Farmland — education, investment opportunities, and news.

I’ve begun to take Farmland investing, specifically Timber Tracts, very seriously. If you want to learn more about AcreTrader — how they select their investments, investment offering details, and everything in between — click this link!

If you’re an accredited investor looking to diversify into an asset class that’s historically uncorrelated to the S&P 500, has displayed decades of stable returns, and certainly isn’t going away — be sure to check out AcreTrader.

My goal is to have 5-7% of my invested portfolio diversified into Farmland over the coming two years. If you all want to hear more about my selection process, returns, and more — let me know!

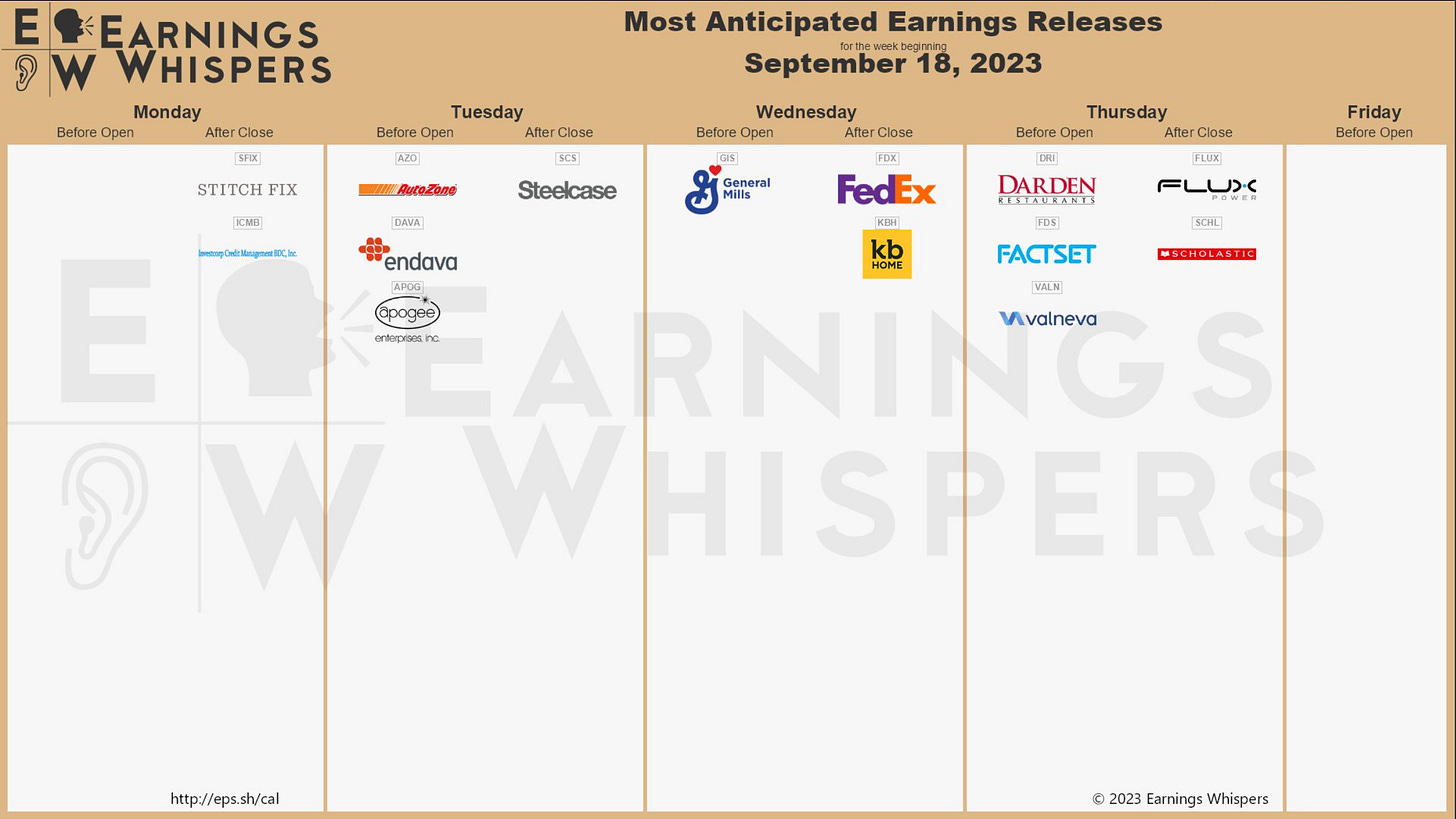

Key Earnings Announcements:

Eating some steak and doing some shipping.

Monday (9/18): Stitch Fix

Tuesday (9/19): Apogee, AutoZone, Endava Steelcase

Wednesday (9/20): FedEx, General Mills, KB Home

Thursday (9/21): Darden Restaurants, FactSet, Scholastic

Friday (9/22): N/A

What We’re Watching:

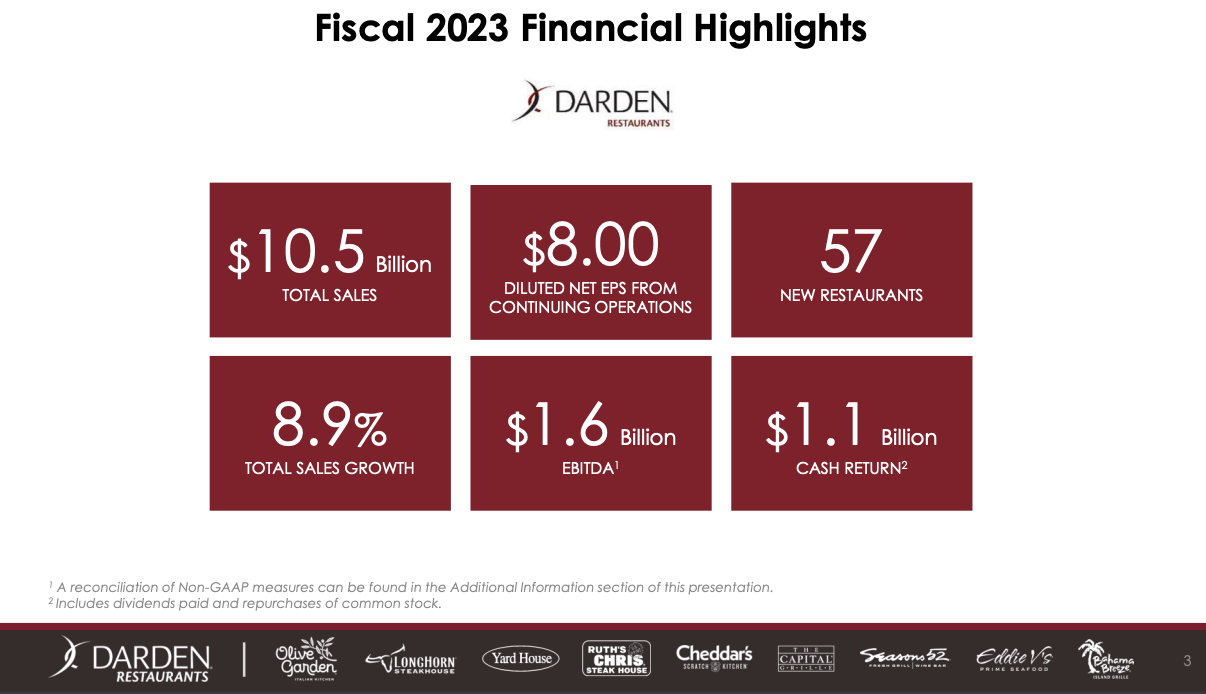

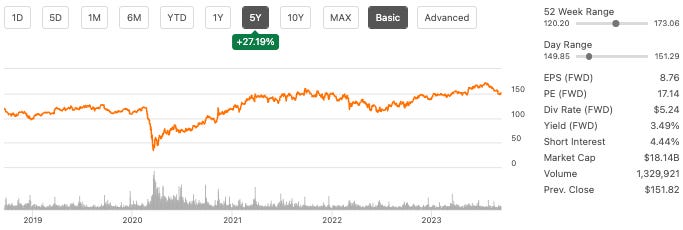

Darden Restaurants (DRI)

One of the key areas that analysts are watching for Darden Restaurants is Segment Profit Margin — with Longhorn Steakhouse and Olive Garden seeing +0.7% and +1.3% growth respectively last quarter. Compare this to the shrinking profit margin in other areas of the company — and there’s certainly a cause for oversight.

Analysts expect $1.73 EPS on Revenue of $2.7 billion.

You can explore the most recent DRI investor release here.

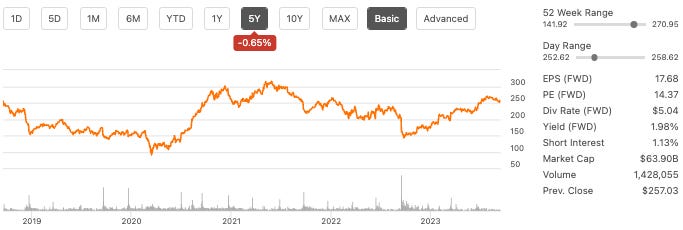

FedEx (FDX)

The tale of the tape for FedEx is all about driving margin expansion, and limiting costs wherever possible. FedEx Ground (-2%), FedEx Express (-13%), and FedEx Freight (-18%) all experiences revenue slides from Q4’22 to Q4’23. Analysts will be focused on guidance for the coming year and will want to hear about energy costs and how the company is positioned for margin improvement.

Analysts expect $3.70 EPS on Revenue of $21.8 billion.

You can explore the most recent FDX investor release here.

Investor Events / Global Affairs:

Ken Griffin is apprehensive, Treasury yields had a weird scene this weekend, Amazon’s ready to flex some product muscles, Tesla may get in bed with the Saudis, and Oracle’s CloudWorld event returns.

Warnings from Citadel CEO Ken Griffin

“I’m a bit anxious that this rally can continue. Obviously one of the big drivers of the rally has been the frenzy over generative AI — which has powered many of the big tech stocks.

I’d like to believe that this rally has legs — but I’m a bit anxious that we’re sort of in the 7th or 8th inning of this rally…

It takes about a year to two years for an interest rate hike to work its way through an economy — it’s not instantaneous. We’re now at the point where we’re going to see the impact of these hikes really start to play out.

We’re seeing the job market start to weaken. There’s been a number of news stories in recent weeks about how companies are willing to pull back what they’re paying for starting roles.

We’re seeing signs that consumers have had enough in terms of price increases, that they’re starting to walk away from products that are tying to push through price increases.

So there’s signs here that we’re heading very quickly into hopefully the soft landing, potentially a more difficult scenario.”

Not to mention… this weekend saw an absolutely bizarre jump in the 2YR (above), 10YR (above), and 30YR yields. Now they are back closer to where they were, but this was simply odd.

Many are calling it a glitch, and others are asking how there could be a glitch to one of the most important set of data points in the financial world.

Amazon (AMZN) Devices & Services Event

Amazon's annual Devices and Services event — scheduled for this Wednesday (9/20) — is expected to showcase new hardware and software innovations. While exact details remain undisclosed, there are several anticipated announcements.

These include the possibility of introducing generative AI capabilities to Alexa, allowing it to generate answers and offer much more comprehensive / customized suggestions.

Additionally — a new Echo speaker launch is anticipated given its absence from last year's lineup, as well as the unveiling of an updated Fire TV Stick 4K and further updates to the popular Kindle Scribe.

The fate of the Kindle Oasis is uncertain — as it hasn't seen an update since 2019 and may potentially be discontinued.

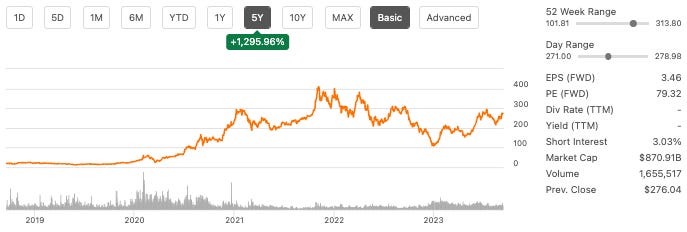

Tesla (TSLA) & Saudi Arabia in Early Talks for EV Factory

Saudi Arabia is reportedly in early talks with Tesla about the possibility of establishing a manufacturing facility within the kingdom.

This move is part of Saudi Arabia's broader efforts to secure the metals required for mass EV production and reduce its dependence on oil over time — despite being the global authority in the oil game.

The talks are preliminary and could face complications due to Tesla CEO Elon Musk's supposedly strained relationship with the Saudis and Saudi Arabia's existing partnership with EV competitor Lucid Group (LCID).

The kingdom is also seeking to attract foreign investment and gain access to metals abroad as it focuses on renewable energy and EV-related ventures.

“If successful, a deal with the Saudis could help Tesla realize its aspirations to sell 20 million vehicles a year by 2030, up from around 1.3 million in 2022.

Toyota was the top-selling automaker globally in 2022, with 10.5 million vehicles.”

Oracle CloudWorld

Oracle’s marquee annual conference is this week — with CloudWorld 2023 returning to Las Vegas.

Here’s the link to the site. Many of the country’s most influential companies — like Microsoft (MSFT) and Nvidia (NVDA) — will have a presence there.

We’ll report back if anything substantial comes out of this event!

Major Economic Events:

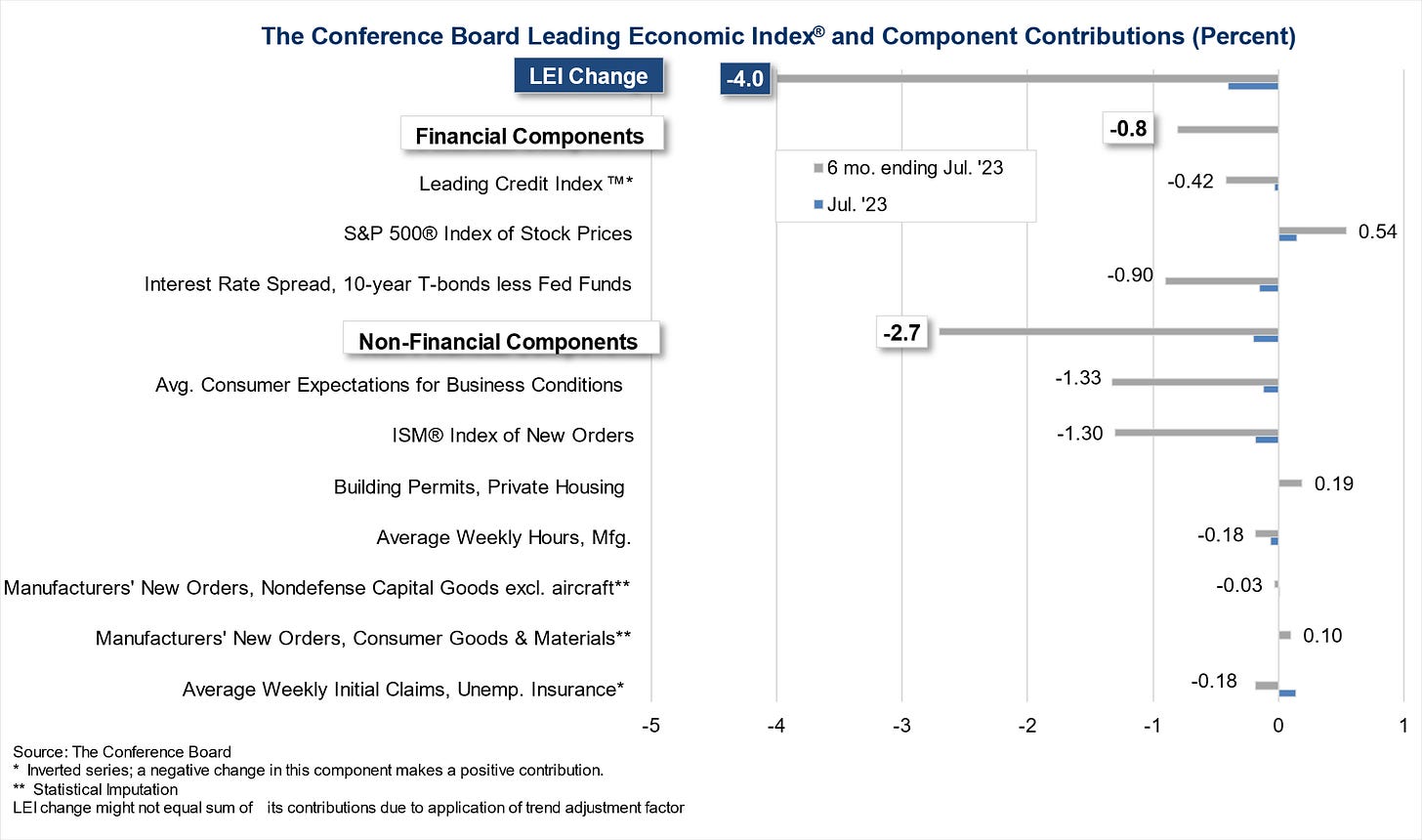

Some believe that the Fed saying “higher for longer” will rock the market, and the Conference Board’s Leading Economic Index will break down areas of weakness to consider as investors.

Monday (9/18): Home Builder Confidence Index

Tuesday (9/19): Building Permits, Housing Starts

Wednesday (9/20): Fed Interest Rate Decision, Press Conference by Fed Chair Jerome Powell

Thursday (9/21): Existing Home Sales, Leading Economic Indicators, Philadelphia Fed Manufacturing Survey, U.S. Current Account Deficit

Friday (9/22): S&P Manufacturing PMI (Flash), S&P Services PMI (Flash), Speeches by Fed Gov Cook, Minneapolis Fed President Kashkari, and San Francisco Fed President Daly

What We’re Watching:

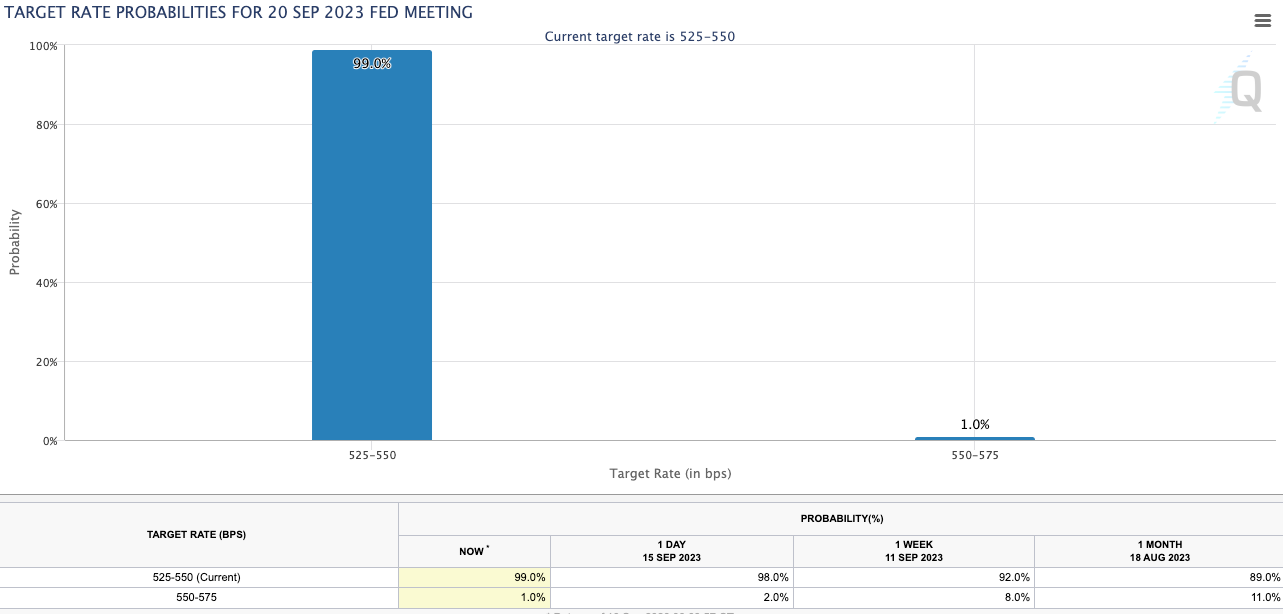

Fed Meeting Considerations

This is about as sure as we’ve ever seen the projections for a Fed rate decision.

If you’re having a tough time seeing the numbers above, there’s a 99% chance of this week’s Fed meeting resulting in no rate hike.

However, rates being raised later this year is very much still a possibility — with many Fed officials citing economic data points as not being sufficient enough to reverse course.

Last week’s release of the University of Michigan’s Consumer Sentiment Index showed a significant decline of inflation expectations. Meanwhile, recent CPI and PPI data was a smidge hotter than analysts would’ve liked.

Sunaina Sinha Haldea — Raymond James’ Global Head of Private Capital Advisory — believes that “higher for longer” will be a negative surprise for investors.

Leading Economic Index

If you’re a consistent reader — you know we love this metric. The Conference Board’s Leading Economic Index returns this week — giving a comprehensive view of turning points in the broader business cycle, and where the economy is heading in the near term.

We’re specifically paying attention to the categories of Leading Credit, New Orders, and Consumer Expectations for Business Conditions.

If you’re starting your investing journey or are interested in buying T-bills yielding 5% or more, consider visiting Public.com.

Overall Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Disclaimer for AcreTrader Financial, LLC member FINRA|SIPC:

Alternative investments are considered speculative, involve a high degree of risk, including complete loss of principal and are not suitable for all investors. Past performance does not guarantee future results and there is no guarantee this trend will continue. Sources *(n.d.). Annual Historical Farmland Returns. NCREIF Farmland Index. You cannot directly invest in an index. Does not represent results of a real investment.

This is a sponsored promotion for the AcreTrader platform. Austin Hankwitz may have investments in companies represented on the AcreTrader platform. This informational newsletter is by no means a promotion, solicitation, or recommendation of any specific investment.

Hi Austin,

Elon has denied reports of a manufacturing facility in Saudi:

https://x.com/elonmusk/status/1703790503286972701?s=20