The Investing Week Ahead: 5/23/22

Retailers need a saving grace, Zoom hopes to avoid a knockout punch, Average home sale prices shatter records, and McDonalds looks to keep the arches golden.

The end of Spring and beginning of the Dark Ages?

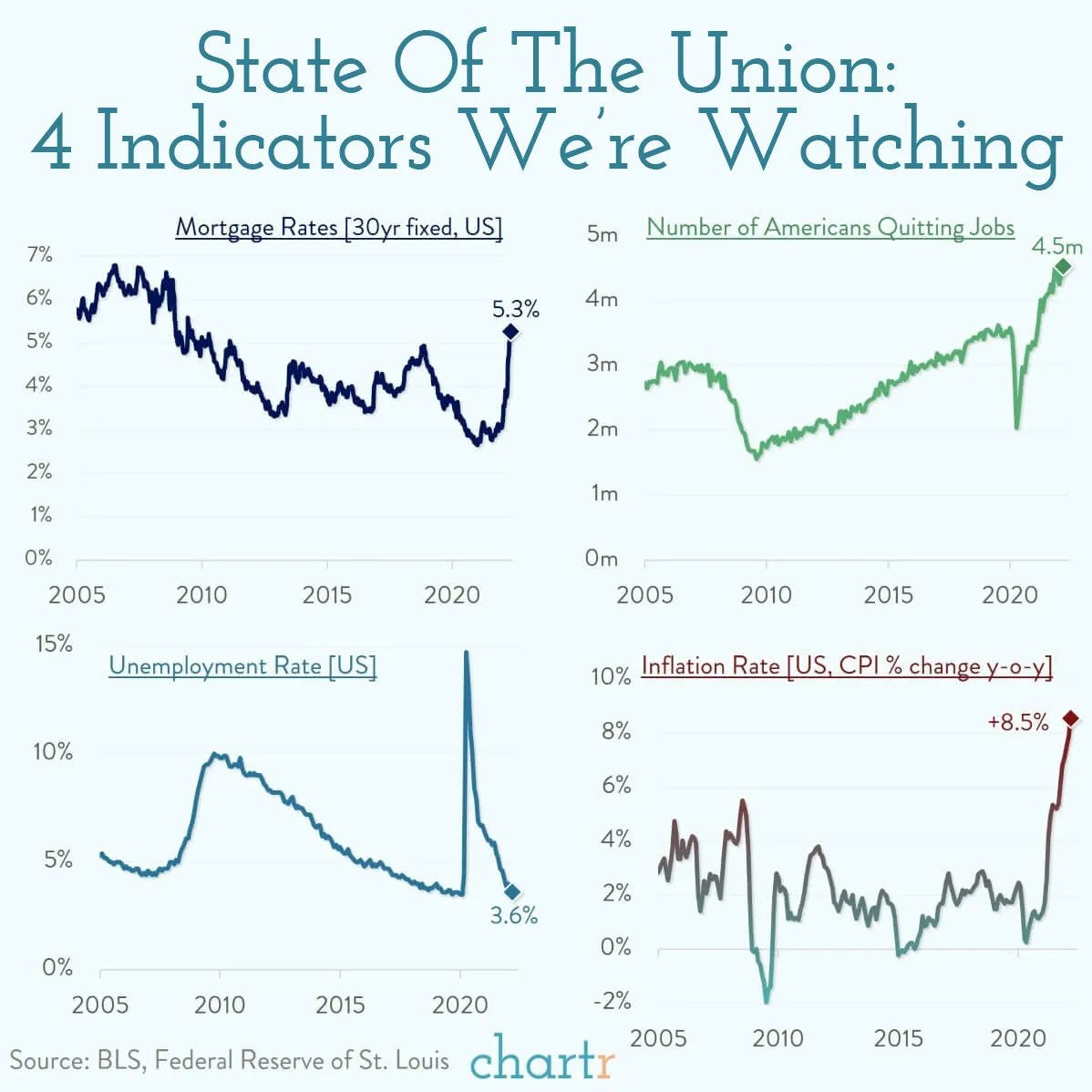

That’s sure what it feels like nowadays. Below are four key metrics to keep an eye on over the next 6-12 months (especially during the inevitable lull of summer).

If the unemployment rate begins to rise, we may be in for a world of trouble. Regardless — we know it’s not the Dark Ages and we’ll be very happy that we piled into investments as the market approaches a bottom.

The Investing Week Ahead - Too Long, Didn’t Read:

⚡ More earnings woes are expected heading into Memorial Day Weekend.

⚡ Events from JPMorgan, McDonald’s, and Microsoft are getting attention.

⚡ Average home sale prices reach a record high, FOMC Meeting Minutes linger.

Key Earnings Announcements:

We’re guessing there will be a lot less Memorial Day sales events this go ‘round.

Monday (5/23): Advanced Auto Parts, XPeng, Zoom

Tuesday (5/24): Abercrombie & Fitch, AutoZone, Best Buy, Dole, Intuit, Nordstrom, Petco, Ralph Lauren, Star Bulk Carriers

Wednesday (5/25): Box, Dick’s Sporting Goods, Nvidia, Snowflake, Splunk, Williams-Sonoma

Thursday (5/26): Alibaba, American Eagle, Autodesk, Baidu, Build-A-Bear Workshop, Burlington Stores, Costco, Dell, Dollar General, Dollar Tree, Gap, Macy’s, Marvell Technology, Ulta Beauty, Workday, Zscaler

Friday (5/27): Big Lots, Canopy Growth, Sanderson Farms

What We’re Watching:

Buy to Save America: More consumer-facing companies are in the spotlight this week as investors are spooked by the sell-offs of Target and Walmart last week. Here’s a video I shared about the situation yesterday.

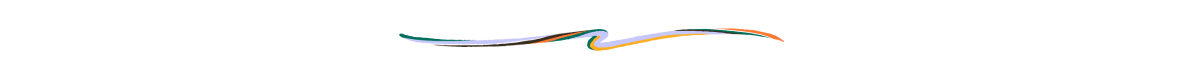

“Your Mic is Muted”: Zoom Video seems to be at an inflection point after falling -72% over the last year. The stock’s EV / EBITDA ratio — which sat at a mind-numbing 184x estimate during the peak of the bull run — has now fallen to ~13x. It’ll be interesting to see if this stock can recover, or if it’s simply a bull run bust that’s been taken over by Google Meet & Microsoft Teams.

Investor Events:

McDonald’s Annual Meeting and four conferences are expected to reveal the health of many S&P 500 companies.

Monday (5/23): Didi Global Hosts Meeting on Delisting in the US, JPMorgan Investor Day

Tuesday (5/24): DC Blockchain Summit, Novartis Investor Event

Wednesday (5/25): CarGurus Investor Day

Thursday (5/26): John Deere Investor Event, McDonald’s Annual Meeting, Vroom Investor Event

Throughout the Week:

Computex 2022 — AMD, NVDA & NXPI present

JPMorgan Global Tech, Media & Communications Conference — CMCSA, CSCO, EBAY, GOOG, INTC, LYFT, V & VZ present

Microsoft Build Conference — Updates to ATVI Acquisition, Azure, Office, and other software / service developments

UBS Global Healthcare Conference — 100+ companies in attendance

What We’re Watching:

McWorried About Inflation: More eyes than usual are expected to tune in for the McDonald’s Annual Meeting. Considered the model for publicly-traded fast food restaurants, MCD is expected to serve as a bellwether for the health of the industry.

Buffett Bets Big: In late April, it was revealed that Berkshire Hathaway took an increased stake in Activision Blizzard — betting that the merger with Microsoft will go through. Buffett owns ~9.5% of Activision Blizzard shares.

Major Economic Updates:

The FOMC Meeting Minutes are in focus, as the market tries to gauge if 50 bps rate hikes will remain the plan.

Monday (5/23): Two Fed Presidents Speak

Tuesday (5/24): New Home Sales

Wednesday (5/25): Durable Goods Orders, FOMC Meeting Minutes

Thursday (5/26): Pending Home Sales Index

Friday (5/27): Consumer Spending, PCE Inflation, Personal Income

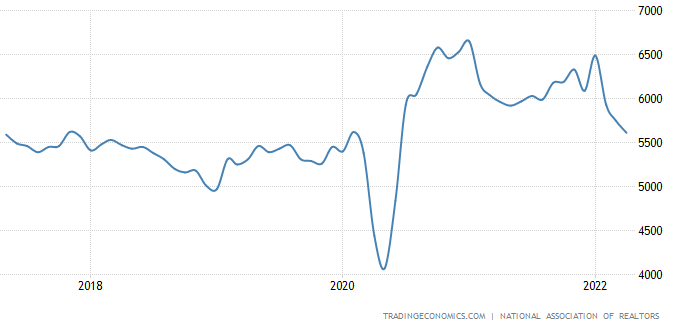

Shoebox Livin’: According to the National Association of Realtors, existing home sales (shown above) fell to its lowest level since the start of the pandemic. The median price of an existing home sold in April was $391,200, the highest on record and an increase of +14.8% year-over-year.

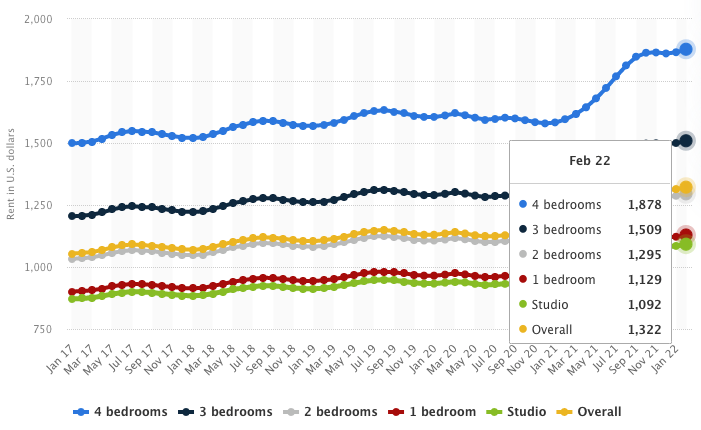

With price tags that high, millions of Americans are deciding to just keep paying landlords before even thinking about real estate:

Events-Driven Winners:

What specific events are moving stocks the most?

Love seeing Clear Secure down just -9% YTD, compared to the rest of the market. Here’s a link to yesterday’s Week in Review — which features an earnings recap of the airport-line life saver.

If you’re starting your investing journey or want to change to a cleaner, social-focused investing platform, consider visiting Public.com.

If you find these Week Ahead posts helpful, please consider sharing with a friend! Have a great start to your week!

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.