The Investing Week Ahead: 5/2/22

April Showers aren't likely to bring May flowers - with negative GDP, the Fed, supply chain issues, and probability of more negative earnings prints holding us down.

Welcome to the first week of May.

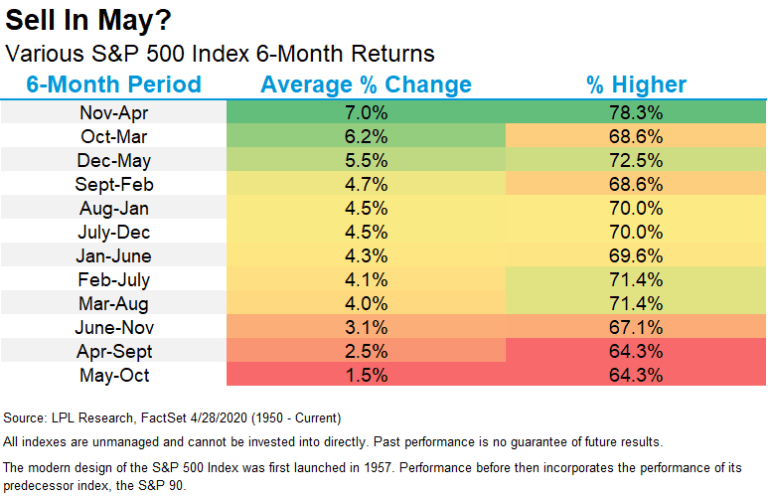

Here’s to hoping that the market doesn’t follow the classic “Sell in May & go away” saying.

Despite 80% of companies that have reported earnings to date beating analysts’ expectations, the S&P 500 fell -9%, the Dow dropped -5%, and the Nasdaq cratered -13% in April — its worst month since October of 2008.

The Investing Week Ahead - Too Long, Didn’t Read:

⚡ After a shocking negative GDP print last week, investors pray for quality earnings.

⚡ If the Fed reveals a +0.75% rate hike, the market is expected to go straight down.

⚡ The all-important US Jobs Report comes at the end of the week.

Key Earnings Announcements:

The next companies in the line of fire.

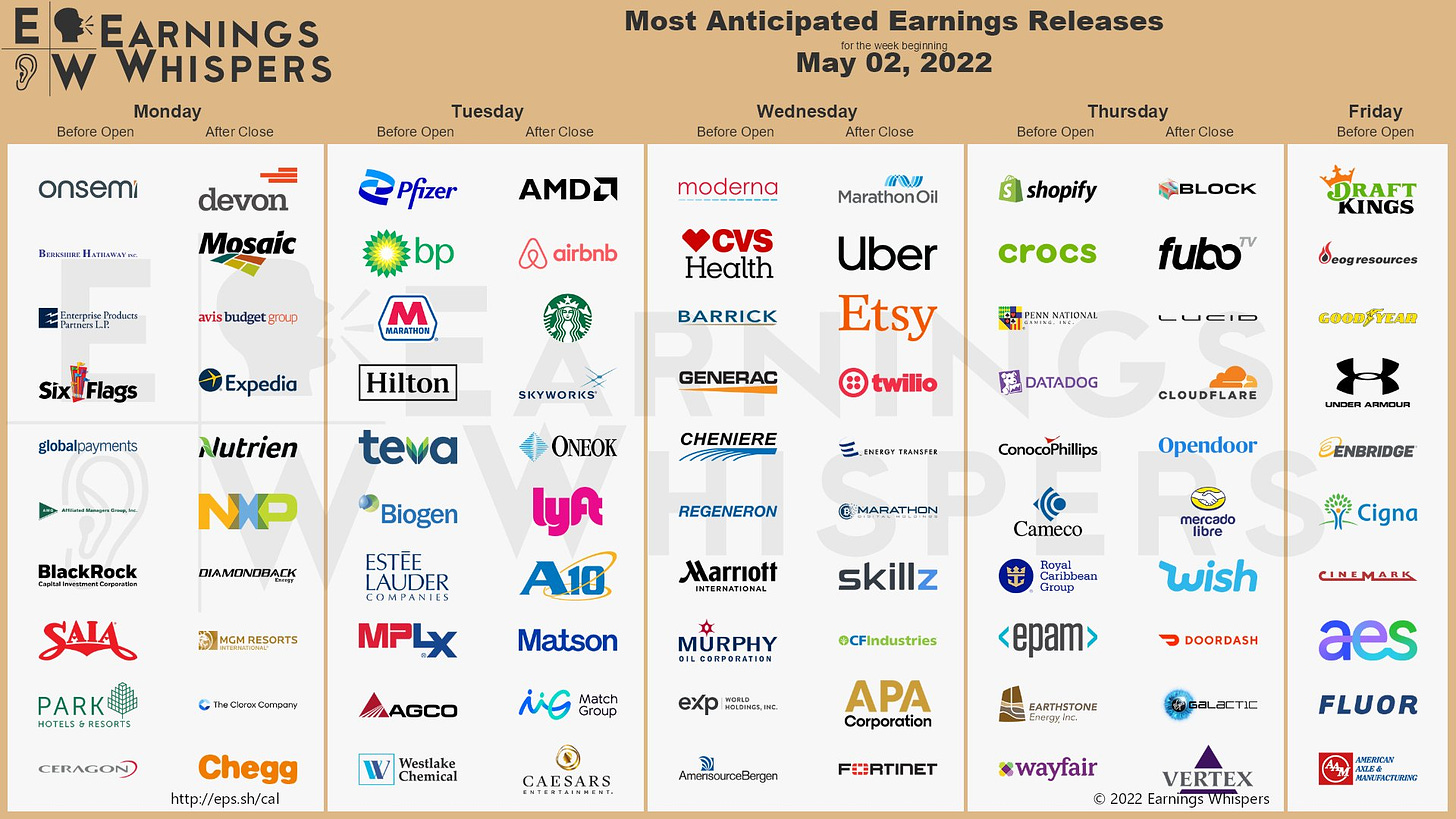

Monday (5/2): Berkshire Hathaway, BlackRock, Chegg, Devon Energy, Expedia, MGM Resorts, Mosaic, NXP

Tuesday (5/3): Airbnb, AMD, Biogen, BP, Caesars Entertainment, Estée Lauder, Hilton, Lyft, Marathon, Pfizer, Starbucks

Wednesday (5/4): AmerisourceBergen, CF Industries, CVS Health, Etsy, Fortinet, Marathon Oil, Marriott, Moderna, Twilio, Uber

Thursday (5/5): Block, Crocs, Cloudflare, ConocoPhillips, Datadog, DoorDash, Lucid Motors, Mercado Libre, Opendoor, Penn National Gaming Virgin Galactic, Wayfair, Zoetis

Friday (5/6): Cigna, DraftKings, Goodyear, Under Armour

What we’re watching:

Continuation of Tech Pain? After disappointing earnings results from both Amazon and Netflix, all tech stocks feel like they’re on thin ice. We’ll be keeping a close eye on Airbnb, Lyft, DoorDash, Fortinet, Twilio, Opendoor, and Uber

Semiconductors — Global semiconductor sales rose +23% year-over-year in Q1, yet the iShares Semiconductor ETF dropped -12.4% over the last month. As there’s likely more downside for the broader market, let’s gauge how much further AMD and NXP could reasonably fall.

Big Buffett Energy — Berkshire Hathaway held its annual shareholder meeting in Nebraska on Saturday. Warren Buffett himself said that he would not buy all of the Bitcoin in the world for $25. Vice Chairman Charles Munger said that bitcoin was “stupid” and “evil.” Interested to see what else may come out of the company’s earnings report — specifically if / when the Buffett gang projects a cycle back to tech exposure. Buffett bought more Apple stock last quarter, but it’ll be interesting to see if that’s the extent of his Big Tech interest for now. Shares of BRK are up +6.5% YTD.

Investor Events:

Chinese EV deliveries, Starbucks dealing with unionization, and putting some respect on Dell’s name.

Monday (5/2): Chinese EV Deliveries (LI, NIO, XPEV), Dell Technologies World Event

Tuesday (5/3): Starbucks to Address Unionization Concerns

Wednesday (5/4): Rate Hikes Revealed at Jerome Powell Press Conference

Thursday (5/5): DoorDash Expected to Reveal Market Share Projections

Friday (5/6): Bausch + Lomb (BLCO) to Begin Trading on NYSE

All Week: Wells Fargo 2022 Industrials Conference

Major Economic Updates:

Investors anxiously await the Fed’s outlook and the US jobs reports needs to be a beauty.

Monday (5/2): Construction Spending

Tuesday (5/3): Factory Orders, Job Openings & Quits

Wednesday (5/4): Conclusion of FOMC Meetings, Trade Balance Update

Thursday (5/5): OPEC+ Meeting to Update Oil Production Outlook

Friday (5/6): US Jobs Report & Unemployment Rate

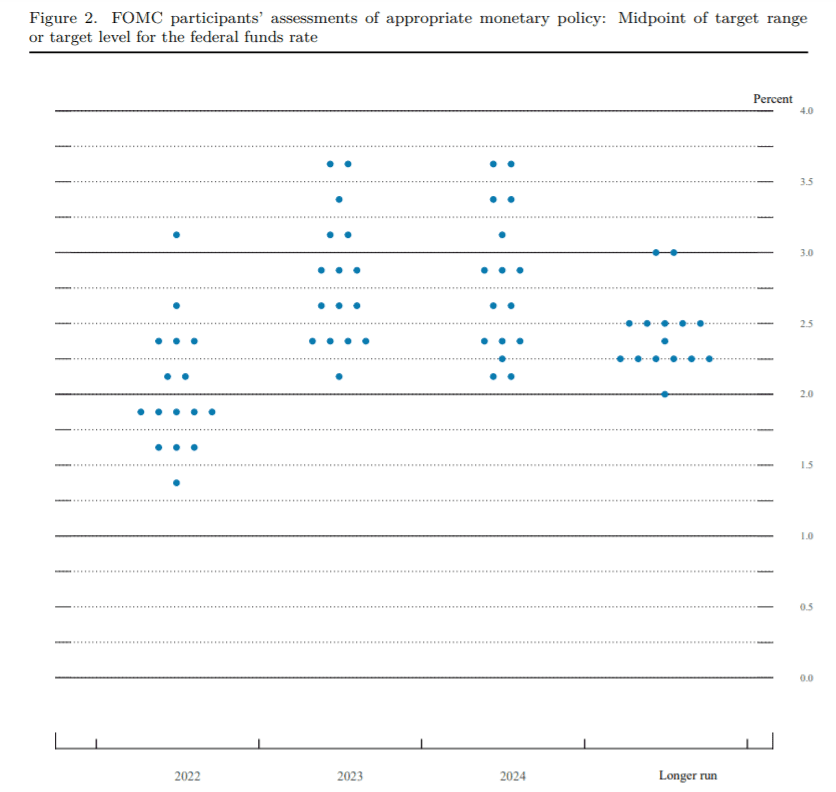

It’s not the prettiest thing in the world, but take a look at the chart above — then look at it again. It shows the ‘votes’ of each FOMC member as to how they’d like to see interest rates rise over time.

As of Friday, the fed funds rate sat at about 0.33%. Practically all of the members would like to see this rate effectively hovering around 2% by the end of the year. Some would like to see that doubled to ~4% by the end of next year.

It’s important to remember how early we are in the rate-raising process. It’s been all of the talk for months, so many folks believe that the worst has already passed. How much of this is all “priced in” already for the broader market? It’s difficult to say, but this is your friendly warning to not fight the Fed.

Events-Driven Winners:

What specific events are moving stocks the most?

Our friends at LevelFields scrub through thousands of data points each week to determine how events impact stock prices.

Stock buybacks are clearly a go-to way for companies to keep their share price high during times of market volatility. It sure will be interesting to see if Biden succeeds in disincentivizing companies from buying back shares of their own companies. The White House plans to propose new restrictions on buybacks and increase taxes on share repurchases to fuel climate and social spending.

If you find these Week Ahead posts helpful, please consider sharing with a friend! Have a great start to your week!

If you’re starting your investing journey or want to change to a cleaner, social-focused investing platform, consider visiting Public.com.

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.