Social Media Spotlight: 1/28/22

Calling out some of our favorite social posts on relevant economic / market topics.

Twice a month, we like to send along an easygoing post with compelling “SoMe” content. Consider this Rate of Return’s ‘kick back and check out this interesting stuff’ email.

Keeping it to just macro topics this week. Let’s jump in!

Reminder:

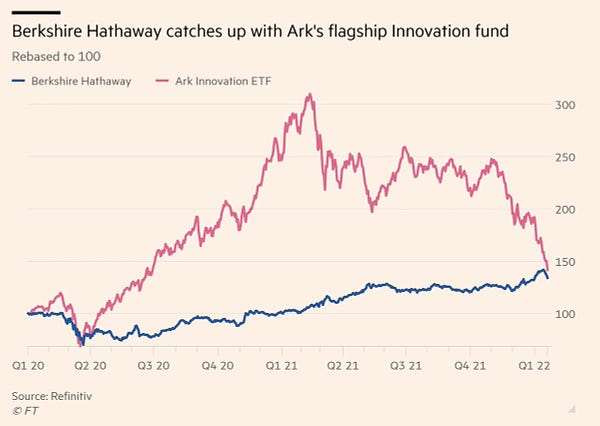

ARK Invest’s CEO and Chief Investment Officer, Cathie Wood, is hosting a Town Hall on Public.com’s app this Tuesday (2/1) at 12p ET. With ARK Invest facing significant criticism lately, I’ll certainly be asking her about current market conditions and the projected growth of her favorite stocks.

I’m pretty sure the only way you can ask her a question is from within the Public App — which you can download / access here.

Topics Include:

The Market Meltdown

Crazy Charts & Stats

The Market Meltdown

This is your friendly reminder that no market, especially the US stock market, moves up in a straight line without falling along the way. Over the last few weeks I’ve gotten messages from folks calling out certain stocks I’ve invested in as “losers” — when those same stocks rose 60-150% in a matter of 6 months.

Always have your risk tolerance in check and always be considerate of when you plan to take profits!

The next tweet is not to say that the S&P Price-to-Sales ratio will drop another 20%, especially considering inflationary pressures help keep this high. It’s more of a red flag that we should keep an eye on.

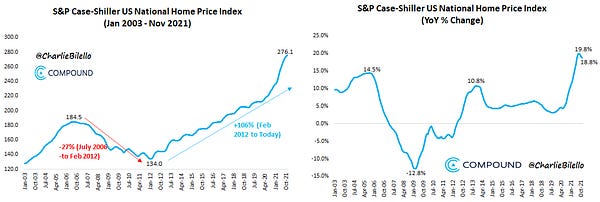

I’ve talked about Warren Buffett plenty of times before, and that’s because he’s one of the greatest investors of all time. One of his leading indicators for the future success of America is household formation.

With surging prices in homes, mass relocations from big cities, and inflation impacting the purchase power of buyers — the single family household shortage continues to soar. This is the reason we follow economic data (especially housing) so closely in the Week in Review posts — they matter.

I’ll be paying close attention to Buffett’s action this year and will relay it to you all.

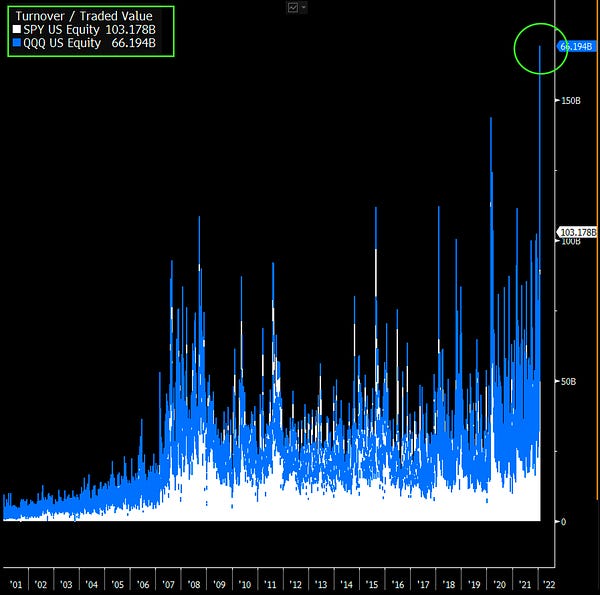

Any way you slice it, the post below means one word — capitulation. Does that mean it’s the end of all the pain? I wouldn’t say that, but I would say that the trading volume on Monday (1/24) was very much a “changing of the guard” moment from bulls to bears. Volatility should be around for awhile.

Crazy Charts & Stats

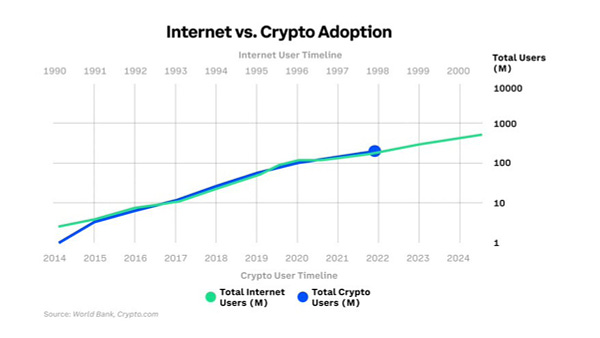

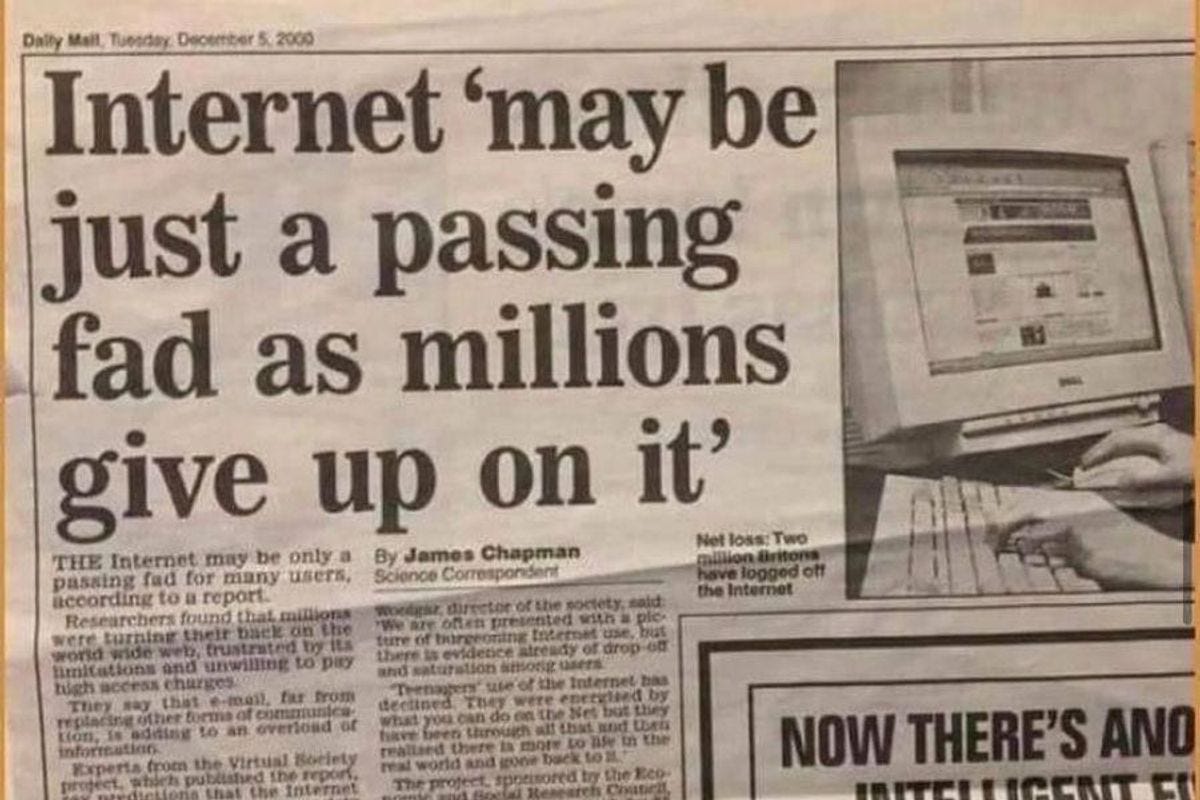

Comparisons like the one below have been made for the last few years, so I won’t harp on it too much. It’s just easy to forget that while history may not always repeat itself, it sure does rhyme. Still long BTC, ETH, and LINK.

Love listening to anything Sima Gandhi, CEO of Creative Juice, has to say about the creator economy.

If you’re well-versed on Chainlink and know what the company is capable of… the second chart in the post below should make you very excited. I wrote this post about Chainlink, with helpful resources to learn more. The price has taken a beating since soaring to start the year, but my long-term confidence in this company and project remains unwavering.

After yet another beautiful Apple earnings report this week, be on the lookout for dips in the stock price during these turbulent times. I most definitely plan to increase my position if the opportunity presents itself.

The NFL Playoffs have been CRAZY. The post below was for Wild Card Weekend, so the biggest names playing that day obviously received more searches than teams like the Chiefs or Titans — who had first round byes.

I surface this tweet not because of the graphic itself, but more encouraging you to pay attention to Google Trends. Our friend, Chris Camillo, has proven that they can be extremely valuable in your investing journey. Maybe next year for my beloved Titans.

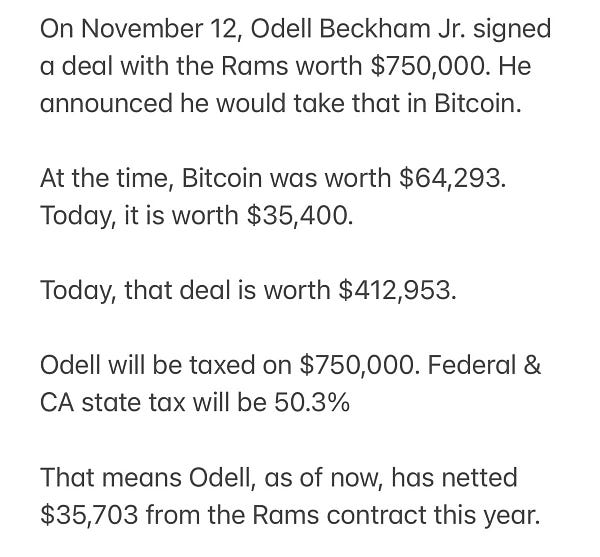

I don’t know about you, but I’ve always found the ‘pay me in bitcoin’ crowd to be a bit much. I love the long-term conviction being expressed by athletes like Aaron Rodgers, Trevor Lawrence, Saquon Barkley, and Odell Beckham Jr. (below).

I just wouldn’t recommend receiving your salary in a historically volatile asset and encouraging others to do the same.

With a tagline of “murder your thirst” and selling 16.9oz “tallboy” cans of water… I just found this one simply too insane not to share. Branding pays.

Have a great start to your weekend!

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Inclusions of Social Media Spotlights don’t necessarily receive our full ‘endorsement’ or complete analytical review.

Hello Austin, thank you for your insight. As a founding member, how do I direct message you if I have question? Please let me know. Thank you,