Social Media Spotlight: 1/14/22

Calling out some of our favorite social posts on relevant economic / market topics.

A lighthearted post for your weekend — below is some social media content that may peak your interest. As a reminder - inclusions of Social Media Spotlights don’t necessarily receive my full ‘endorsement’ or complete analytical agreement. We are simply sharing information that hopefully aid your journey as a business person, market reader, and investor.

Let’s jump in!

Topics Include:

Unique Crypto / NFT Callouts

Supply Chain

Payments Fintechs: Private vs. Public

Rapid Fire: Crazy Statistics

🌐 Unique Crypto / NFT Callouts

—

—

—

—

⛓️ Supply Chain

As badly as we’d like this to become ‘old news’ - it’s not. We are impacted by the combination of widespread shutdowns, coerced job displacement, a broken relationship with China, increased energy costs, winter weather, and more. Be sure to check out that last tweet for a sweet resource regarding supply chain disruptions.

—

—

—

—

💸 Payments Fintechs: Private vs. Public

Publicly-traded companies in this space like PayPal (PYPL) and Block (SQ) were down -20-25% in 2021. Meanwhile, privately-held companies like Stripe ($94B), Klarna ($46B), and Checkout.com ($40B) are reaching astronomical valuation levels.

—

—

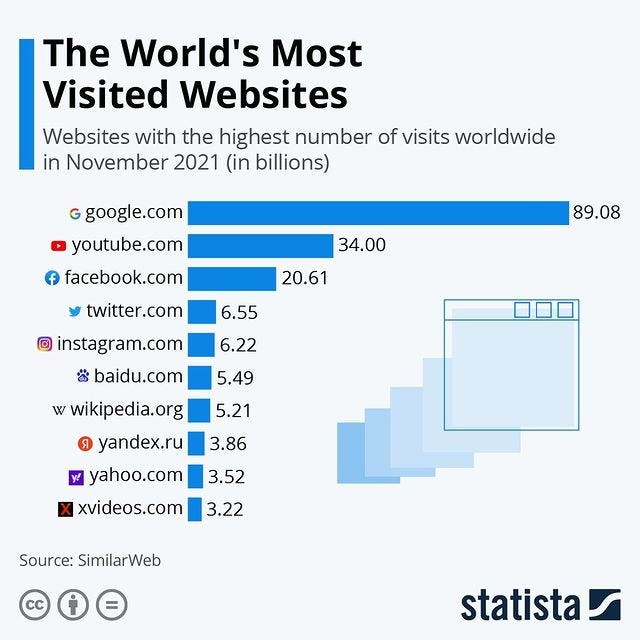

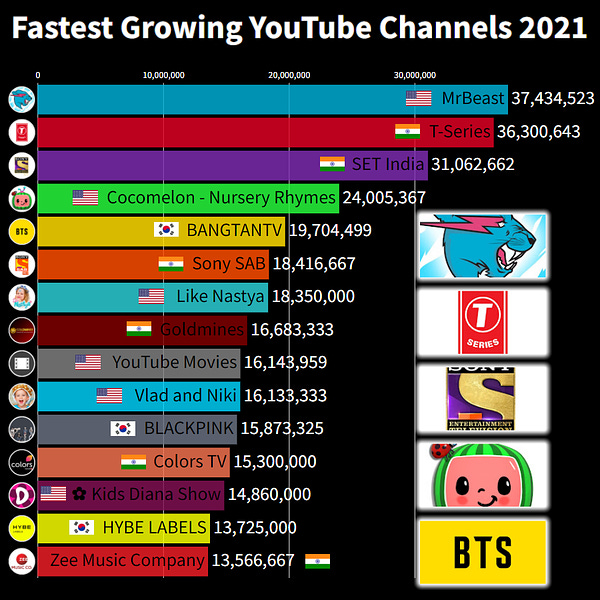

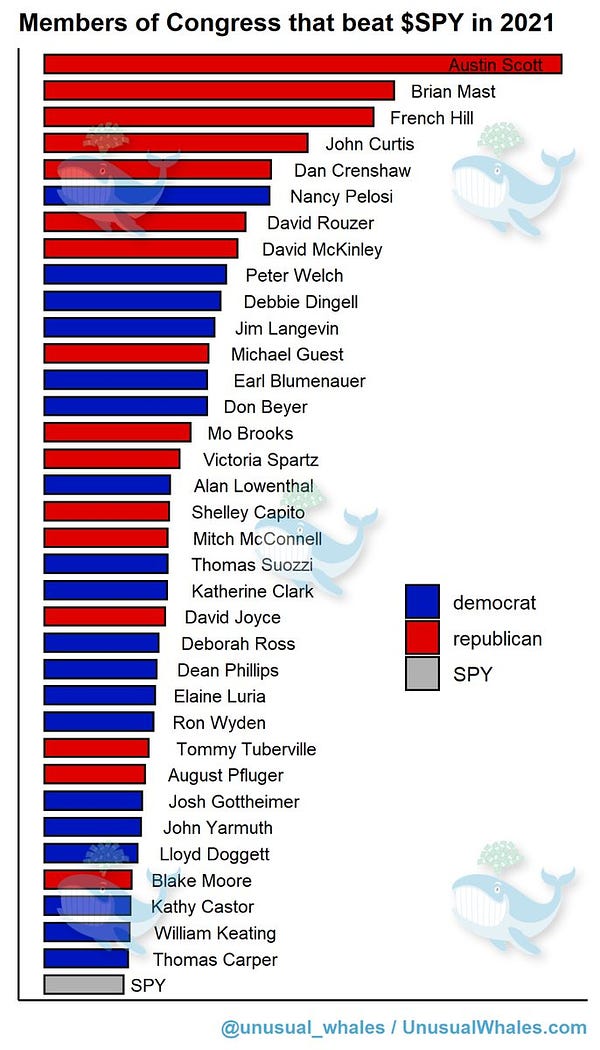

📊 Rapid Fire: Crazy Statistics

It’s justified to say that every single one of these statistics is insane.

—

—

—

—

—

🤠 Bonus Callout:

It’s officially the year of unsubb’ing from the Target or Dick’s Sporting Goods emails, and filling my inbox with more value-adding newsletters. My close friend Tejas just started one with his friends. The plan is to send a weekly update on three valuable nuggets of info from the creator world. Check it out here!

Have a great rest of your weekend. For our East Coast readers — be safe with incoming winter weather!

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.