💪 Selling the Strength (2023 Portfolio)

Time to re-evaluate and reassess as we head into 2023...

⚡️ Introduction

*Important feedback is required at the end of this post

On December 3rd, 2021 — I shared with you all my wealth building strategies, one of which being my stock portfolio. I’m young, therefore I’ve invested aggressively into growth and innovation — while being mindful of my “core” holdings (Mega-Caps).

12 months ago, investing meaningful amounts of money into aggressive growth and innovation made a lot of sense. Interest rates were low — therefore, growth at any cost was a viable strategy for countless tech executives.

Considering the risk-free rate (T-bills) was so incredibly low — risk-adjusted returns were reasonable. It made sense to have exposure to these types of high octane companies.

But, Things Have Changed

As recently explained in this post, things are very different today when compared to 12 months ago. That reality, however, is not what’s driving my decision making — but instead the fact that I believe things will remain very different for years to come.

Allow me to explain myself, then I’ll share with you how I plan to achieve my goal of $80,000 / year in tax-advantaged portfolio income by 2031.

⚡️ What is Portfolio Income?

There are three different types of income people can earn — active, passive, and portfolio — each with their own respective tax implications.

Active income is the easiest to understand — that’s the money your employer pays you for working your job. Wages, salaries, tips — things of that nature. This type of income is taxed the most, with the highest active income tax bracket being 37%.

Active income is how 95% of people in the United States build wealth — and I’m no exception. However, I don’t want to rely on active income as a way to catalyze cash flow for the rest of my life. I’m incredibly passionate (as you all might remember from the launch of this vending machine business earlier this year) about building passive income streams — and I have every intention of my portfolio income being an integral passive income stream for me throughout my life.

Portfolio income is pretty straightforward — it’s money you’ve received from investments, dividends, interest payments, and capital gains.

Most portfolio income, including qualified dividends, receive very favorable tax treatments — as you can see above. In addition, portfolio income is not subject to Social Security or Medicare taxes.

Yes — theoretically speaking, if I’m able to build a dividend growth portfolio worth $2M that yields 4% (and I’m married.. coming soon???), we’d be able to collect $80,000 in cash dividends and would pay 0% in taxes on them.

Sure, this assumes zero income elsewhere — so realistically speaking we’d be paying 15% on the dividend income. But compare that to the 37% tax bracket we’d have been thrown in if instead decided we’d rather earn all of that income actively.

How This Plays Out

I tried to explain things as clearly as I possibly could in our Dividend Growth Portfolio article — the days of rock bottom interest rates (and therefore ‘free money’) are over. I believe the Fed will continue to hike interest rates well into 2023 and keep them there well into 2024 / 2025.

You can read more about that in our recent Week in Review.

This represents a short (but important) opportunity to invest into wonderful companies at depressed valuations.

You can either invest into high-growth / innovative companies with the assumption they’ll eventually flip profitable and their share price will rise upon doing so — or you can invest into already-profitable businesses paying a wonderful dividend to their shareholders.

Both of these types of businesses are trading at depressed valuations and will likely continue to trade below historical averages throughout the coming 12-18 months.

To me, it’s much more important to lay a meaningful foundation of “wonderful businesses paying me a wonderful dividend every year.” Then once that foundation is built — perhaps even simultaneously to an extent — I’ll begin investing more into high-octane and innovation.

I just feel like I’m being given a once-in-a-decade opportunity to build a strong cash flowing dividend growth portfolio (as described here) — and I don’t want to pass that up.

⚡️ The Strategy

I plan to be 100% transparent with you all as I build this dividend growth portfolio from scratch — updating you every step of the way. Now that you understand my reasoning, let’s talk through the end goal — then we can work backwards as to how we’ll achieve it.

Working Backwards

$2M in invested assets — that’s where we’re going.

I think I’ve shared this with you all in the past, but for the sake of transparency — across my two properties, crypto, and stock portfolio — my personal net worth is hovering around $700K.

I’m not sharing this with you brag, and I know you understand that.

Throughout the last 5 years, my crazy early bet on the cryptocurrency Chainlink (LINK) and Nashville real estate have been the two main catalysts driving this figure higher. However, over the coming 5+ years I plan for both my active income and the reinvestments of my dividend income to be the main catalysts driving this figure higher.

From the active income perspective, I have every intention to deploy $180K / year toward building this portfolio. Some years it might be more, some years it might be less — but $180K / year is the goal.

From the dividend income perspective, I’m going to assume a 2% dividend yield for the 2023 calendar year — so we’re looking at ~$3,000 in reinvested dividend income. This figure will increase dramatically as the years tick by.

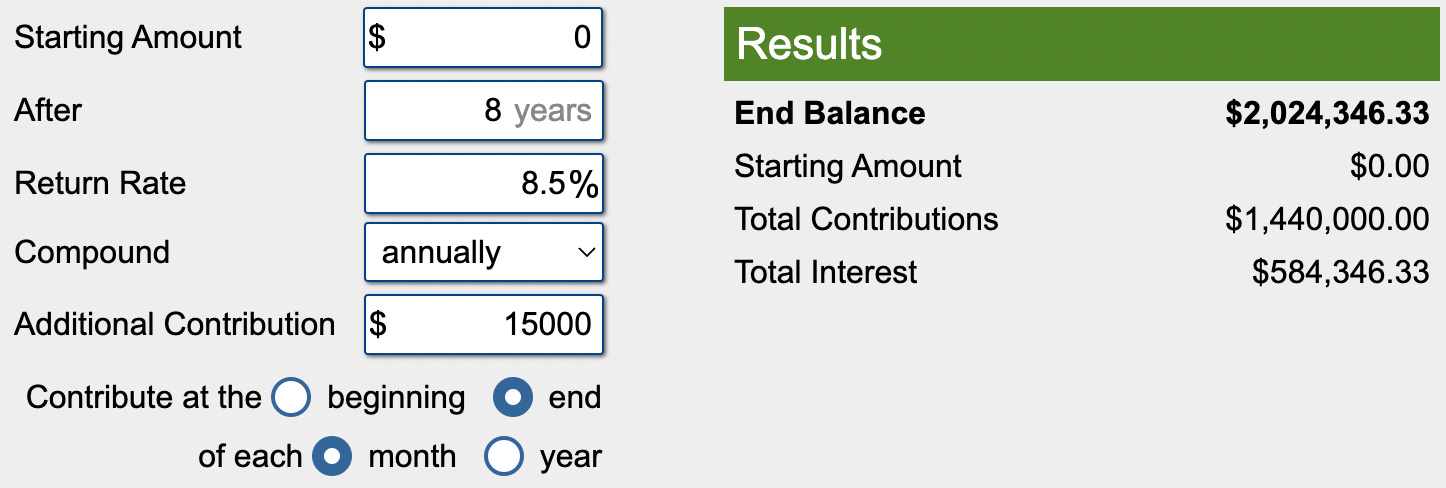

Assuming we want to achieve our $2M goal by the end of 2030 and we’re building this dividend growth portfolio from scratch — we’re going to have to be aggressive with our contributions.

Don’t forget, these assumptions (8.5% annual return, etc.) are long-term multi-decade averages — so if the next few years in the market are as hard as I’m thinking they’ll be .. we have our work cut out for us.

The Compounders

I shared a quick list in this post, but wanted to confirm with you all the companies that I believe will not only grow their annual dividend payments in a meaningful way — but also grow their operating cash flow. By doing so, it’s reasonable to expect their free cash flow per share will grow as well.

And as you all know from this post — free cash flow per share is king.

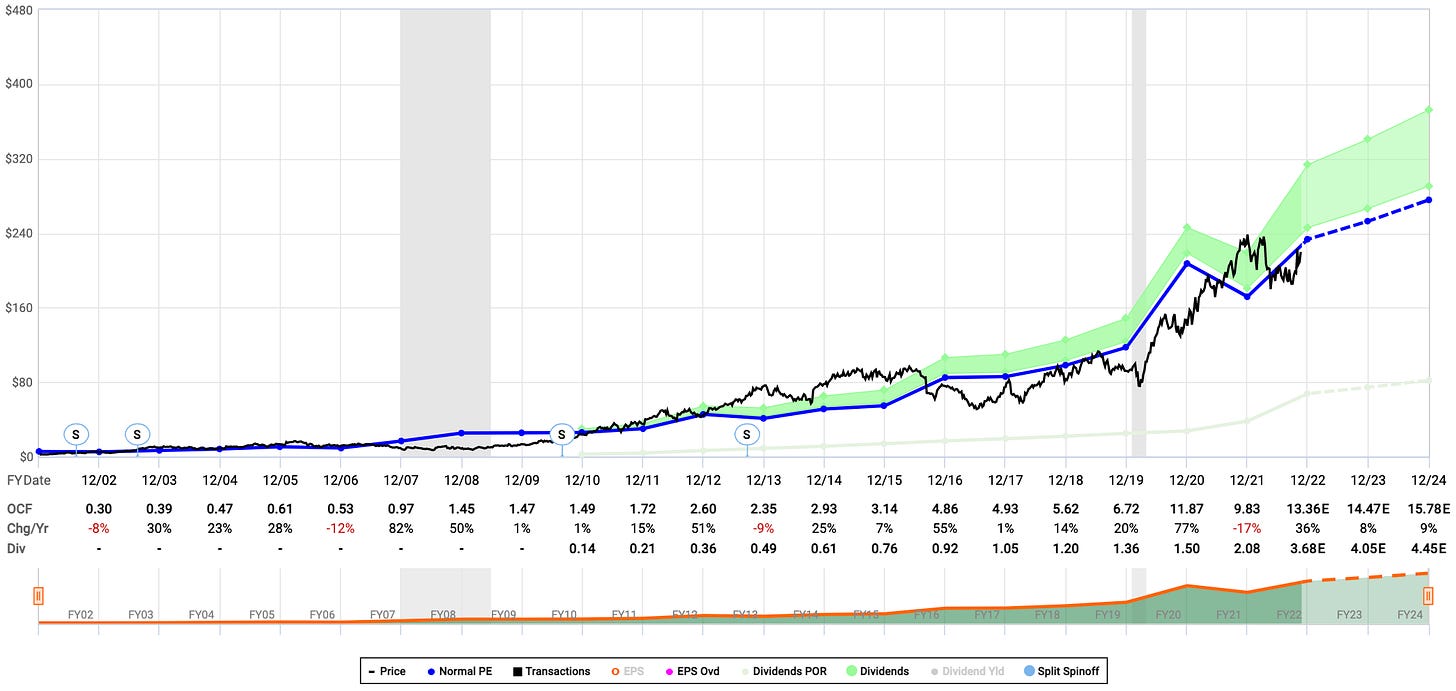

Lowe’s (LOW)

+19% five-year dividend growth CAGR, their payout ratio is 28%, and their operating cash flow (blue line) is forecasted to remain healthy throughout the coming years.

24-month PT: $260 / share (+24% upside)

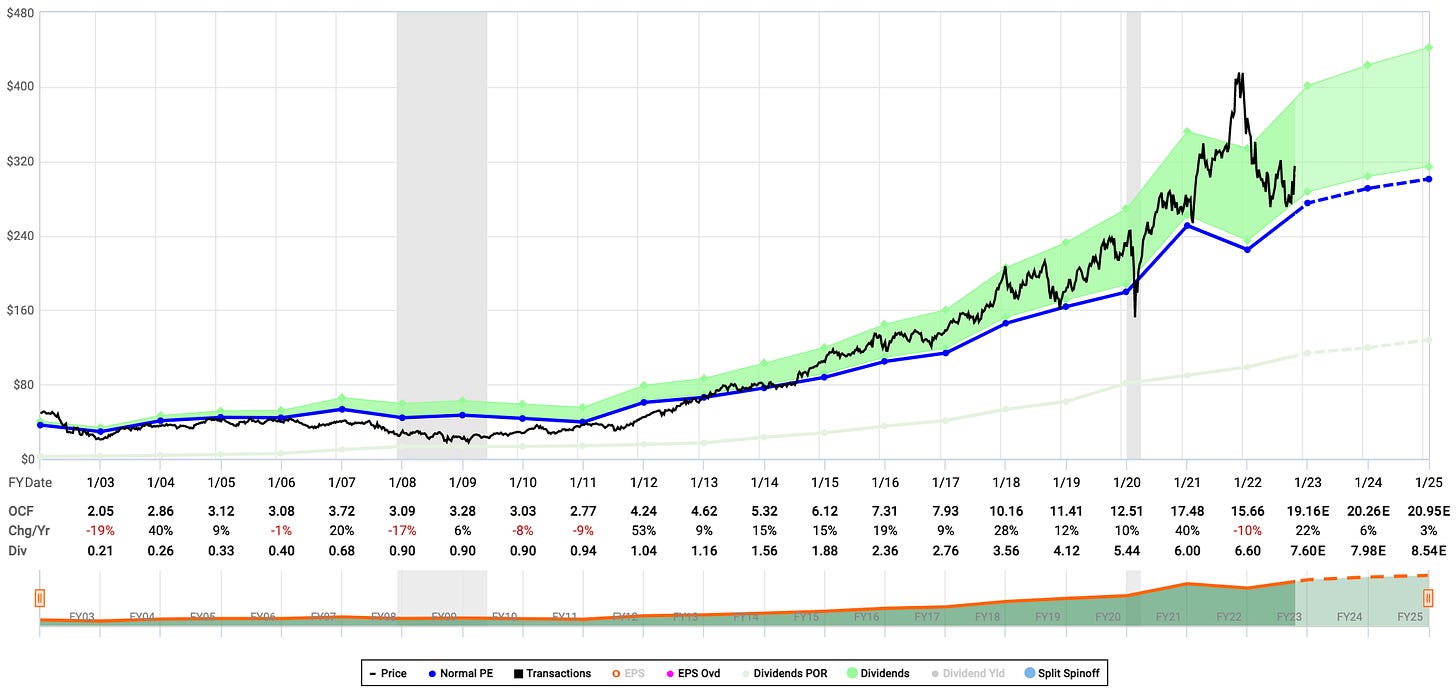

Home Depot (HD)

+17% five-year dividend growth CAGR, their payout ratio is 45%, and their operating cash flow (blue line) is forecasted to remain healthy throughout the coming years.

24-month PT: $360 / share (+14% upside)

Broadcom (AVGO)

+32% five-year dividend growth CAGR, their payout ratio is 47%, and their operating cash flow (blue line) is forecasted to remain exceptionally healthy given the secular growth trend they’re operating within (semis).

24-month PT: $640 / share (+24% upside)

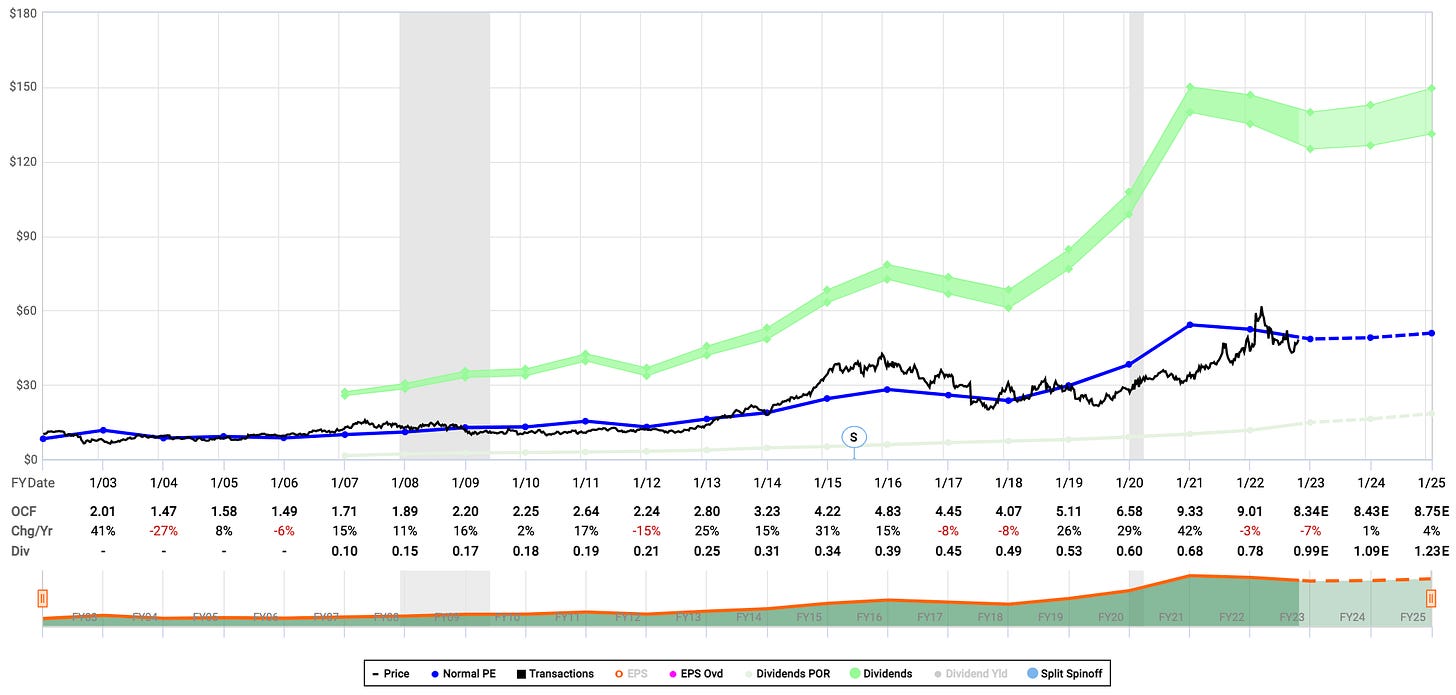

Kroger (KR)

+14% five-year dividend growth CAGR, their payout ratio is only 22%, and their operating cash flow (blue line) is forecasted to remain healthy throughout the coming years. They’re a grocery-heavy retailer — proven to be more resilient during times of macroeconomic uncertainty.

24-month PT: $55 / share (+14% upside)

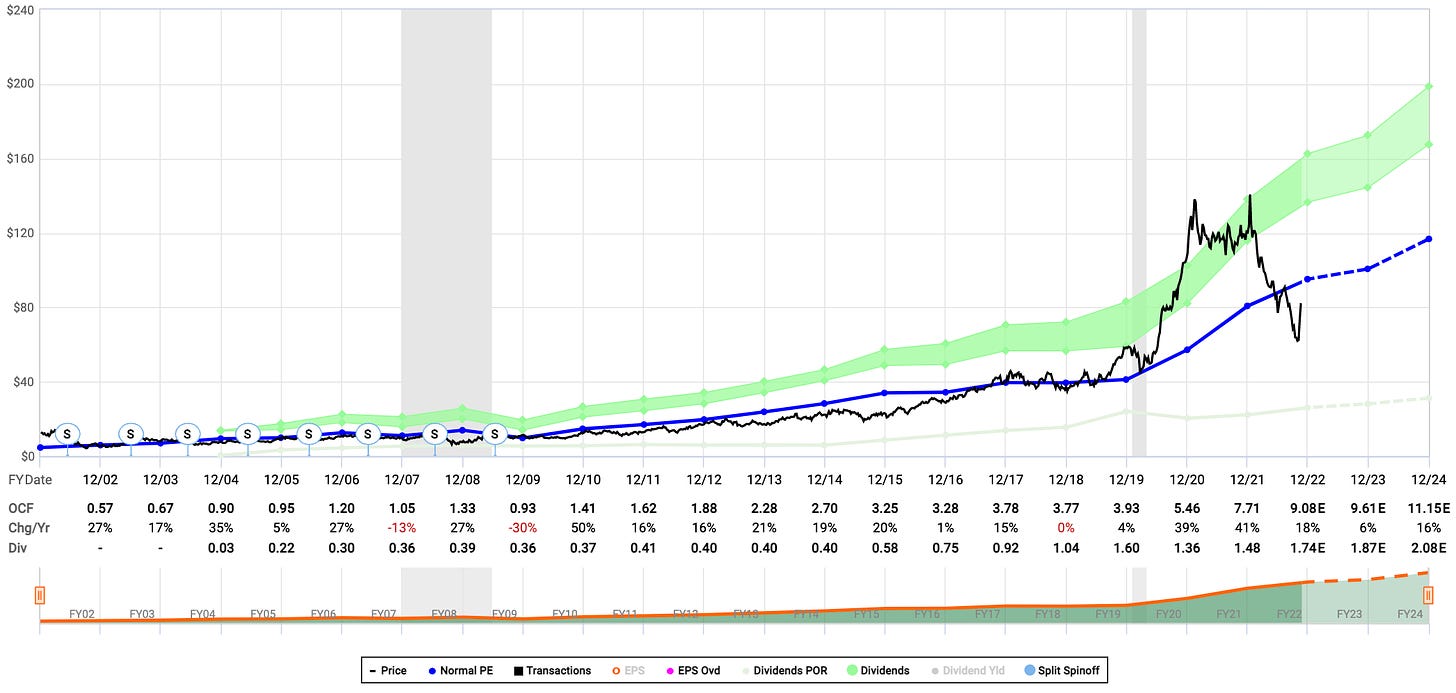

Tractor Supply Company (TSCO)

+28% five-year dividend CAGR, their payout ratio is 35%, and their operating cash flow (blue line) is forecasted to grow by high-single digits throughout the coming years.

24-month PT: $275 / share (+23% upside)

Visa (V)

+18% five-year dividend CAGR, their payout ratio is only 22%, and their operating cash flow (blue line) is forecasted to grow by low double digits throughout the coming years.

24-month PT: $303 / share (+44% upside)

Caterpillar (CAT)

+8% five-year dividend CAGR, their payout ratio is a modest 36%, and their operating cash flow (blue line) is forecasted to grow by >50% over the coming two years.

24-month PT: $200 / share (no upside, waiting for a better entry)

Taiwan Semiconductors Manufacturing (TSM)

+11% five-year dividend CAGR, their payout ratio is only 6%, and their operating cash flow (blue line) is forecasted to grow modestly in 2023, but ramp up in speed in 2024 — driven primarily by the semiconductor secular growth trend.

24-month PT: $116 / share (+40% upside)

ASML Holdings (ASML)

+46% five-year dividend CAGR, their payout ratio is a modest 35%, and their operating cash flow (blue line) is forecasted to grow by >50% over the next two years.

24-month PT: $560 / share (no upside, waiting for a better entry)

Dollar General (DG)

+15% five-year dividend CAGR, their payout ratio is only 19%, and their operating cash flow (blue line) is forecasted to grow by +25% over the coming two years. However, I’ll be the first to admit Dollar General’s stock price is historically over-valued at the moment.

24-month PT: $212 / share (no upside, waiting for a better entry)

The REITs

A dividend growth portfolio isn’t complete without some well-rounded real estate investment trusts (REITs) to bring stability and predictability. The REITs I chose are industry leaders, veterans in their respective niches, and all yield high-single digits.

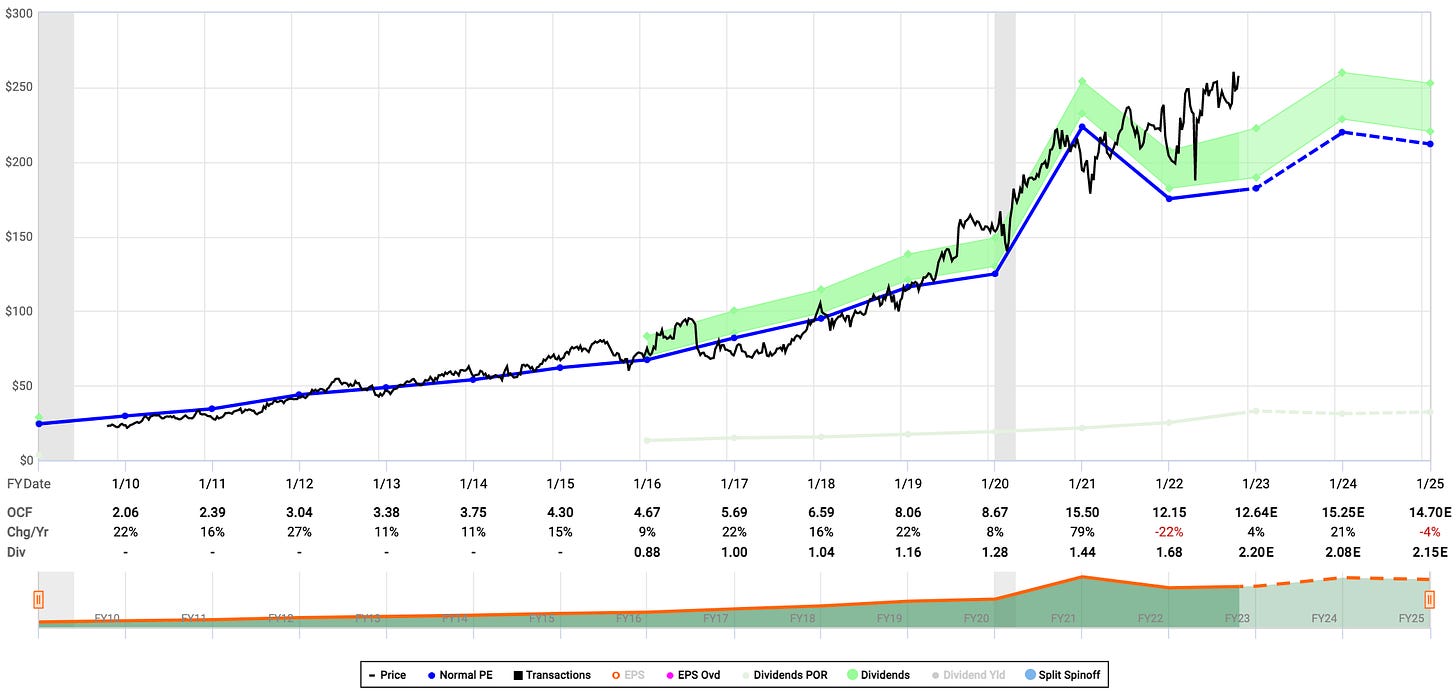

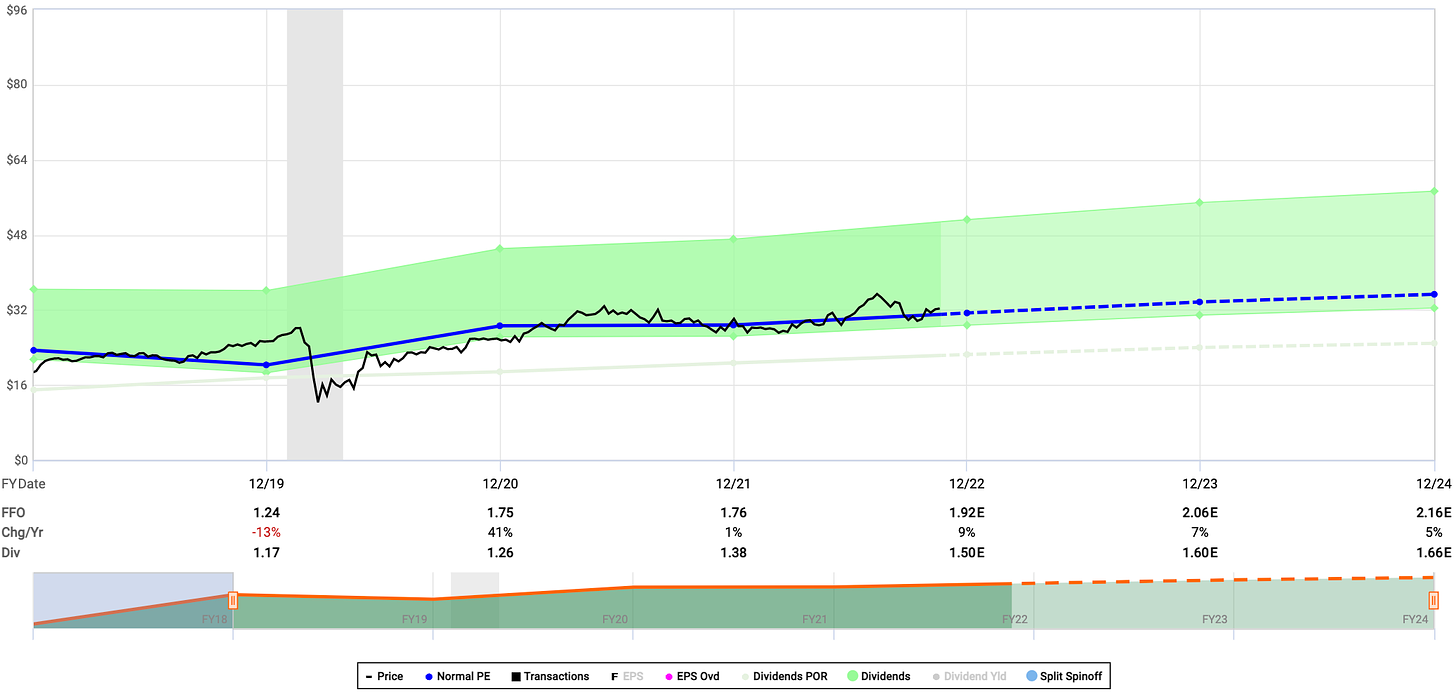

Realty Income Corporation (O)

+4% five-year CAGR, a very modest 80% FFO payout ratio, and their operating cash flow (blue line) is forecasted to continue to grow by low-single digits throughout the coming years.

24-month PT: $75 / share (+15% upside)

American Tower Corporation (AMT)

+18% five-year dividend CAGR, a very modest 44% FFO payout ratio, and their operating cash flow (blue line) is forecasted to grow by +15% over the coming two years.

24-month PT: $270 / share (+24% upside)

Medical Properties Trust (MPW)

+4% five-year dividend CAGR, a modest 65% FFO payout ratio, and their operating cash flow (blue line) is forecasted to grow by low-single digits over the coming years. The company has a portfolio of 430+ properties ranging from general acute care hospitals to inpatient rehabilitation centers. Given our country’s aging population, I’m exceptionally bullish on this REIT over the coming 5+ years.

24-month PT: $23 / share (+77% upside potential)

VICI Properties (VICI)

+11.5% three-year dividend CAGR, a 131% FFO payout ratio, and their operating cash flow (blue line) is forecasted to remain healthy and grow by mid-single digits over the coming years. Including this REIT specifically for what they’re doing with gaming and resorts around the country.

24-month PT: $38 / share (+15% upside)

Special Circumstance

This is how we keep up with the major indices while also collecting meaningful income. Each one of these ETFs track a specific index, while also selling covered calls against their positions — creating high-single digit dividend yields to shareholders.

By owning these, I’ll be giving my dividend growth portfolio moderate exposure to move up and down with the broader indices — while collecting a dividend in the form of option contract premiums.

Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX)

This ETF tracks the performance of the Nasdaq 100. It also sells covered calls against 35% — 75% of the notional value of the fund’s equity portfolio. More information about their activities can be found here.

Schwab U.S. Dividend Equity ETF (SCHD)

This ETF tracks the performance of the Dow Jones US Dividend Index. Its goal is track an index focused on the quality and sustainability of dividends. There are no additional income generating activities going on here.

JPMorgan Equity Premium Income ETF (JEPI)

This ETF generally tracks the performance of the S&P 500. It also sells covered calls against their fund’s equity to generate monthly income for their investors. More information about their activities can be found here.

Before you ask — yes, I’ll continue to invest toward no-brainer oversold growth / innovative tech companies throughout the coming years. I’m actually working on a tech-focused analysis for you all right now. I love uncovering potentially oversold / under-covered gems and sharing them with you all.

With that being said, I think it’s incredibly smart to lay this foundation. Especially if the market is going to "crab around” like we think it might.

I’m also working with Quantbase to have a variant of this portfolio become “investable,” similar to an ETF. We’ve back-tested the positions all the way back to 2012 and below is the data by calendar year.

TL;DR — the portfolio has outperformed the S&P 500 by ~82% in 10 years, with annualized returns of +15.2%, and YTD returns of -0.5%.

We’re still in the “idea phase,” but if you would like the ability to invest into a dividend-first fund of this nature — please let me know! It would take only a few more weeks of work and we’d likely be live with the fund by end of year.

Please drop a comment below letting me know either way.

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Happy Thanksgiving Austin. Thanks for the perspective as we move closer to a more boring market, which lends to opportunities in great companies. Looking forward to the next write up on growth stocks.

Happy Thanksgiving Austin! Great write up, I'd be personally very interested in the Quantbase rollout for this portfolio. Also open if you are looking for early adoption before a larger rollout.

Would just have to understand how the cost structure will be (any fees?) and how they end up reflecting on the potential return of this strategy.