If you can predict the cash flow, you can predict the stock price.

Introduction

If you’re open to learning more about why I love “operating cash flow,” and subsequently “free cash flow” so much — below is a post you might that explains everything.

However, in this post I wanted to share a few names that I’m either actively dollar cost averaging into or learning more about before I open a position.

Let’s jump into it!

Monday.com (MNDY)

In case you’re unfamiliar with the company, they’re a collaborative workflow management software for businesses of all shapes and sizes.

We’ve been bullish on this company for several quarters now, and their recent earnings release further solidified our bullish thesis.

— Q1 Earnings Results:

Revenue: $162.3 million (+50%)

Operating Loss: -$22.7 million, compared to -$67.5 million last year

Net Loss: -$14.7 million, compared to -$66.7 million last year

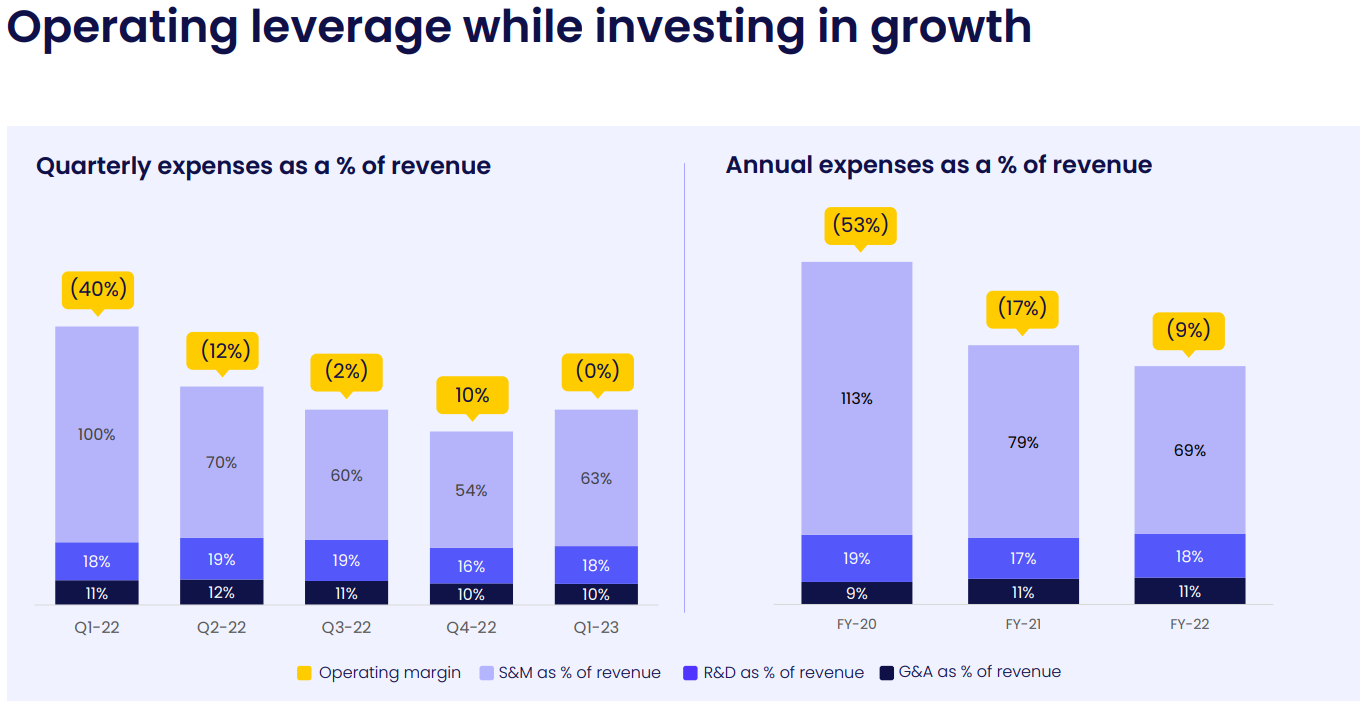

The name of the game with this company is “economies of scale.”

Essentially, this means as a company (specifically, technology companies) grows in size, their fixed expenses become smaller and smaller in relation to their revenue.

You can see this phenomenon on display in the illustration above — quarterly expenses as a percent of revenue have decreased from negative -40% (running at a loss) to now 0% (breakeven).

Once they eclipse “operating profitability,” everything beyond that is gravy. This “operating profitability” is ever changing and quite challenging to overcome for a lot of companies.

However, Monday.com has done an incredible job of proving they have what it takes and that their product is in such demand that they’ll be able to offset their operating expenses in full.

As you can see above, the company is also free cash flow positive and is clearly starting to create a trend of positive free cash flow into the future.

“We now expect to report positive free cash flow on a consistent quarterly basis moving forward, and to achieve our third consecutive year of being free cash flow positive in 2023.”

Why I’m Excited

This is every technology company’s dream — becoming both free cash flow and operating cash flow positive. Once this is achieved it’s simply a numbers game — how much revenue can be generated and thus shimmy down to the bottom line?

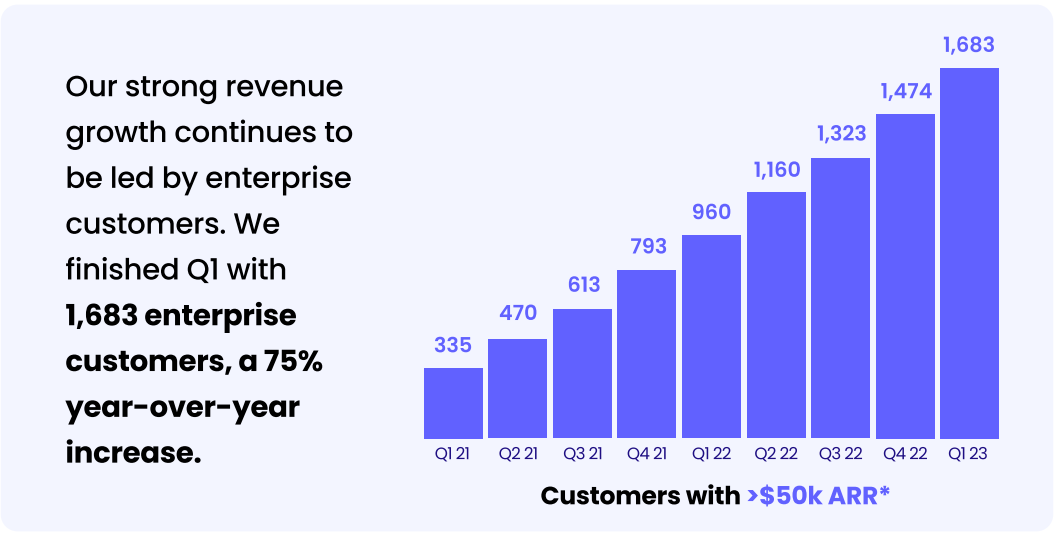

The company’s strong revenue growth continues to be fueled by enterprise customers spending more than $50K / year with them — sticky, high-value customers if you ask me.

This revenue growth will continue into the future — 2024 revenue should land around $900M, and 2025 revenue around $1.1B. This growth paired with their existing operating profitability will catalyze $200M+ in operating cash flow and $150M+ in free cash flow in 2025.

This figure will continue to grow over the coming decade into billions of dollars — pushing their market capitalization into the tens of billions over time.

At $165 / share ($7B market capitalization), I’m a happy shareholder and will continue to dollar cost average into my growing position.

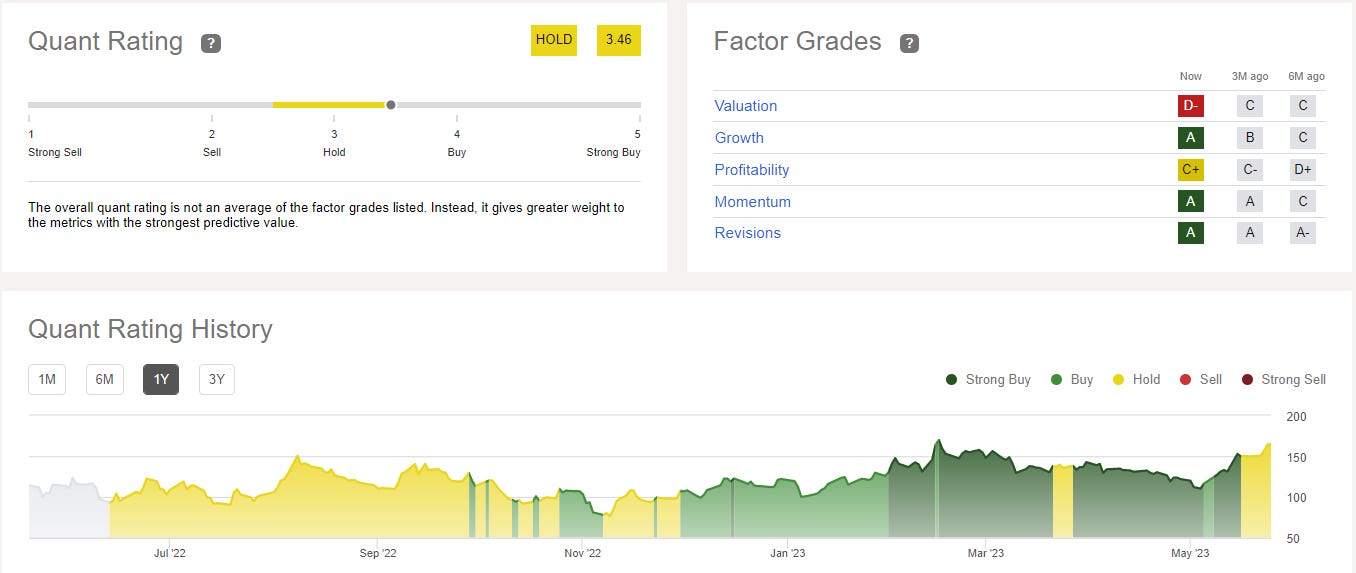

Above is a screenshot from their Quant Rating on SeekingAlpha — they were a “Strong Buy” for months, and recently flipped to “Hold” after the recent run up in price after earnings.

Uber (UBER):

In case you’re unaware, Uber operates three business segments: mobility, delivery, and freight. I’m sure we’ve all ridden in an Uber or had Uber Eats delivered.

We’ve also been bullish on this company for about 6 months now, but only recently pulled the trigger on investing given their incredible Q1 earnings results.

— Q1 Earnings Results:

Revenue: $8.8 billion (+29%)

Operating Loss: -$482.0 million, compared to -$262.0 million last year

Net Loss: -$5.9 billion, compared to -$157.0 million last year

The name of the game for Uber is quite literally their adj. EBITDA turnaround story — catalyzing their immense free cash flow.

Their margins are low, and that’s to be expected with the line of work they’re in — however, this company has done an incredible job of sharing their adj. EBITDA expectations and actually executing upon them.

Below is a reconciliation of their free cash flow — coming in at a whopping $549M during Q1!

It might be hard to read, so feel free to click on the image and zoom in.

Why I’m Excited

This company, like many other technology companies, has never been adj. EBITDA or free cash flow positive until recently.

If you can predict the free cash flow, you can predict the stock price.

This company’s revenue is expected to reach $37.5B in 2023, leaving ~$3.5B to shimmy down to the adj. EBITDA line item, and ~$2.5B in free cash flow.

That ~$2.5B begins to expand tremendously as we look ahead toward the future — coming in around $4.1B in 2024, and $5.8B in 2025.

Uber is quickly turning into a free cash flow printing machine.

I’ll be the first to admit, at $75B in market capitalization the company on the frothy side — even when we account for the free cash flow growth. However, I’m confident the market will continue to assign value to this company over the coming 24 months as they execute upon their 2025 financial guidance.

Above is their Quant Rating by SeekingAlpha — right now, it’s a “Strong Buy.”

Two Companies I’m Researching

As always, I want to do my best to share with you all my research and intentions before I actually make trades — with that being said I’m further researching two names right now.