(MANGO): Semiconductor Stocks

Diving deep into a new acronym used to describe top semiconductor stocks.

Setting the Stage

We’ve all likely heard of the acronym FAANG used to describe some of the biggest publicly traded companies in the country (Facebook, Apple, Amazon, Netflix, Google) — but have you heard of MANGO?

Marvell Technology (MRVL)

Advanced Micro Devices (AMD)

Analog Devices (ADI)

Broadcom (AVGO)

Nvidia (NVDA)

GlobalFoundries (GFS)

Onsemi (ON)

In this post, I’ll be sharing exactly what companies make up “MANGO,” their financials, what Wall Street thinks of them, and finally — my own thoughts.

Should We Even Invest in Semiconductors?

Absolutely. Maybe not today, maybe not tomorrow — but yes. Semiconductors should be a part of any well-balanced, long-term portfolio.

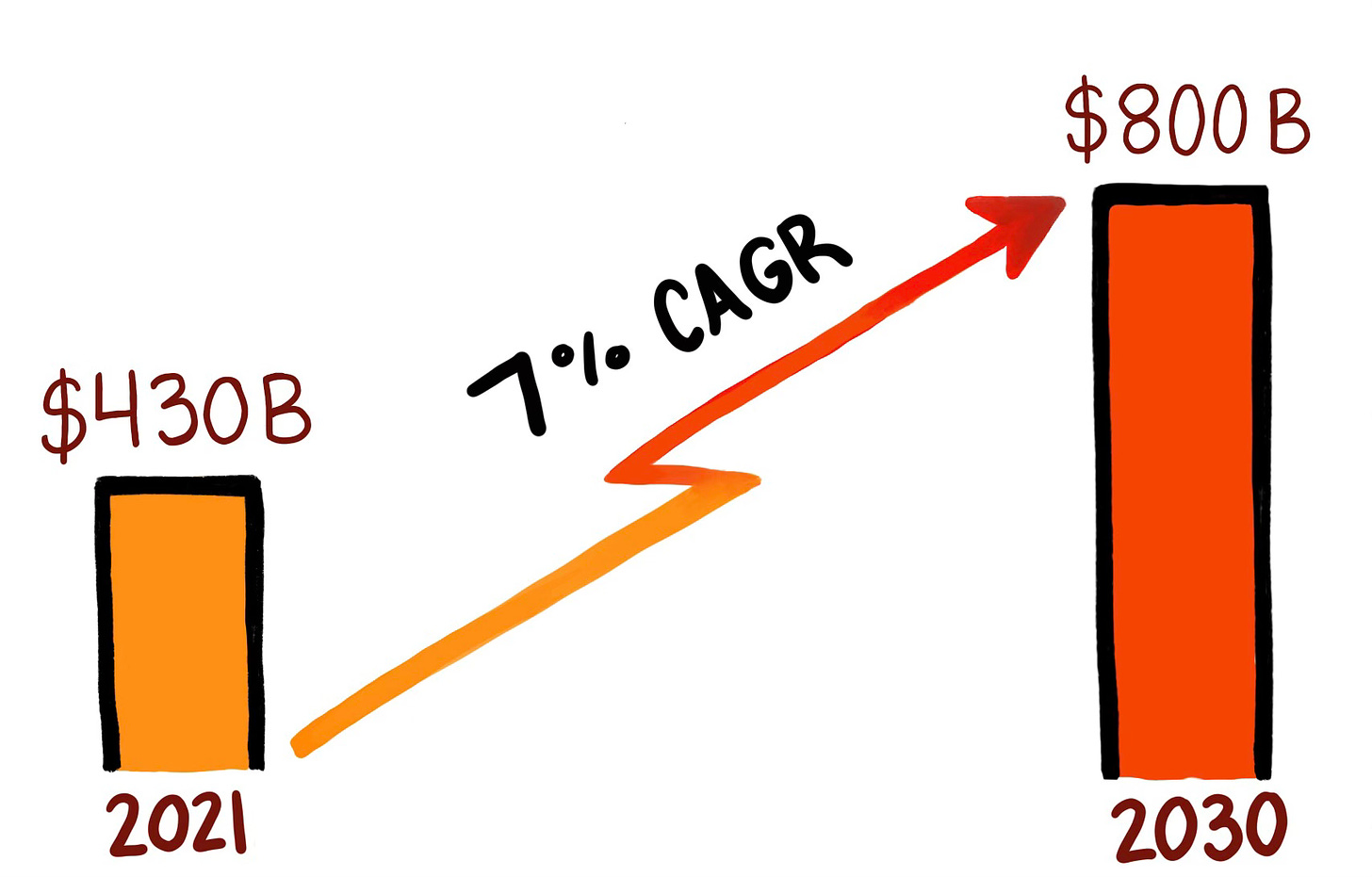

In 2021, the global semiconductor market was value at ~$430 billion. Projected to grow around a +7% CAGR through 2030, the market will eclipse $800 billion by the end of the decade.

To ensure everyone’s on the same page when we toss around terms like “market,” we’re specifically talking about total addressable market (TAM). Essentially, this means the total revenue opportunity that is available to a company if 100% market share is achieved.

For example, Nvidia did $27 billion in revenue in 2021. Since the global semiconductor market was ~$430 billion during 2021, Nvidia only captured ~6% of global market share. The other ~94% market share was split up between the countless other companies operating in this space.

Now you might be asking yourself “What's driving this growth?"

A ton of different things — smartphones, electric vehicles, data centers, cloud computing, heck — even your fancy new refrigerator.

Using Nvidia again as an example — if you select the “Products” tab on their website, you find a laundry list of different product offerings. Gaming & entertainment, laptops & workstations, cloud & data center, networking, GPUs, and embedded systems.

Each one of those product categories has another 4+ subcategories below them — there’s a lot driving this growth into the turn of the decade.

Marvell Technology (MRVL)

Designed for your current needs and future ambitions, Marvell is a supplier of infrastructure semiconductor solutions. They mainly serve five markets — data centers, carrier infrastructure, enterprise networking, consumer, and automotive / industrial.

The company has been trading on the stock market for nearly two decades, with their most recent earnings release printing earlier this month. Revenue grew by +68%, gross profit margins expanded to 51%, and profits came in around $6 million.

Looking forward, the company is expected to grow revenue by +50% throughout 2022 — while maintaining gross profit margins of ~50%. Given their margins, growth, and continually-expanding industry, their free cash flow during 2022 is expected to triple to $1.8 billion.

💰 Current Price: $74 / share

🏦 Bank of America PT — Vivek Arya: $115 / share

“Marvell's broad portfolio of IP in computing, optics, networking, storage, and security, along with its scale and commitment to process leadership (5nm ramping, 3nm roadmap), positions it solidly in our view to address the growing need for customized, high performance silicon in the cloud, enterprise, 5G telco and automotive markets.

We reiterate our Buy, $115 PO (or $100bn market cap), and a top compute pick on MRVL.”

⚡️ My Thoughts: Excited

This company is doing everything right.

They’re operating in a massively sticky and growing industry, they’re expanding their margins, and are aggressively printing free cash flow for their shareholders. I recognize their competition (Nvidia, Intel, Broadcom) but Marvell is differentiated by having doubled down on providing the infrastructure for this digital transformation we’ll continue to experience throughout the decade.

The focus of their underlying infrastructure points to the ‘data center’ industry — with 85% of their sales going toward it. We all know ‘data is the new oil’ and massive companies are doing everything they can to collect, interpret, and act upon data.

Advanced Micro Devices (AMD)

This high-performance and adaptive computing company views the world as its oyster. They mainly operate within three segments — computing & graphics, enterprise, and embedded & semi-custom.

This was one of the first stocks I bought when I began investing more seriously in college after reading about them on the infamous r/wallstreetbets subreddit. I’ll never forget how happy I was when I bought 10 shares for $13 and sold them for $30 a few months later — wild times.

The company reported their earnings early-February. Here’s the breakdown — revenue increased +49% for the quarter and +68% for the year of 2021. Their gross profit margins expanded 560 bps to 50%, catalyzing their operating income to grow by +112%. Profits for the quarter were down substantially, but relatively flat for the year.

Looking forward, the company is expected to grow revenue by more than +30% during 2022. Despite the slowing revenue growth, adjusted EBITDA and profits are expected to double. However, free cash flow will likely grow in tandem with revenue.

💰 Current Price: $124 / share

🏦 Truist Securities — William Stein, CFA: $144 / share

“Good — nearly everything. AMD delivered an impressive beat and raise with strength across end markets, and up & down the P/L.

The magnitude of AMD's upside, especially in the Q1 guidance, combined with what looks like conservative full year 2022 guidance, feels like a smack to our face commanding us to upgrade.

Our reluctance is related to what we see as ever-increasing competitive pressures. Share shifts can occur quickly in the processor market. We believe that a reinvigorated Intel (Hold) with its eyes on process parity vs TSMC (NR) in 2024 and leadership in 2025, poses a share challenge. Meanwhile, NVDA's (Buy) established GPU accelerator business, its emerging DPUs this year, and CPUs in the next couple of years, pose a growing challenge relative to AMD's X86 market. We see neither threat as a risk to near term estimates, but both as challenging AMD's share gains over the longer-term.”

⚡️ My Thoughts: Excited

Sure, I understand Wall Street’s concerns around competitive pressures and rapid share shifts in this market — but AMD isn’t showing any signs of that. This analyst above mentioned a reinvigorated Intel could cause disruption — I’d argue they won’t.

Despite this impressive growth in 2021, AMD’s market share of PC / server CPUs is likely less than 15% — leaving plenty of upside to be had as they continue to steal revenue share from Intel, a company continually navigating manufacturing challenges.

Here’s what I don’t like about them — shareholder dilution given the Xilinx acquisition in 2020, tough growth comps, and a high valuation multiple in relation to their peers. However, there’s no reason to count this company out — they’re just getting started.

Analog Devices (ADI)

Described as the global leader in the design and manufacturing of analog, mixed signal, and DSP integrated circuits, Analog Devices designs, manufactures, and tests a broad portfolio of solutions. These include integrated circuits, software & subsystems that leverage analog, as well as mixed signal & digital signal processing technologies.

The company reported their quarterly earnings early-February and they were stellar. Revenue during the quarter grew +72%, adjusted gross margins were 77%, and adjusted operating income grew by +93%.

Looking forward, revenue expected to grow by another +54%, gross margins will continue to expand, as will their operating margins. If everything goes well, the company will more than 3X their profits in 2022 and double their free cash flow. Mind you, this company is maintaining free cash flow margins above 30%.

💰 Current Price: $168 / share

🏦 Bank of America — Vivek Arya: $220 / share

“ADI’s strong execution provides double digit sales growth, peer leading free cash flow margins, strong stock buybacks, and strong free cash flow growth through 2024. We believe the best is yet to come as capacity additions in the back half at Oregon / Lamerick fabs help deliver double digit YoY growth throughout the year despite facing tough compares.”

⚡️ My Thoughts: Intrigued

Referencing this post, Analog Devices has been on my watchlist for some time now. I’m definitely excited about this company’s incredible ability to buyback their shares off the market — retiring more than 3% of their entire share count (>$2.6B). ADI’s management team has made clear their intentions to repurchase another $5B by the end of 2022, another plus. Finally, as 5G deploys around the world — Analog Devices is poised to benefit given their product offering.

I’m not ignoring their rising capex, but I don’t think in the long-term their margins will suffer.

Broadcom (AVGO)

Broadcom is a global technology company that designs, develops and supplies semiconductor and infrastructure software solutions. It mainly operates between two segments — semiconductor solutions and infrastructure software.

The company reported their quarterly earnings earlier this month, with expectations of acceleration on the horizon. Their revenue increased +16% to $7.7 billion for the quarter, with adjusted EBITDA on that revenue coming in higher than $4.8 billion. Profits nearly doubled, growing almost +$1.1 billion when compared to the same quarter in 2020.

Looking forward, their revenue is expected to grow +16% in 2022 to nearly $32 billion. With gross profit margins expected to remain well above 70%, free cash flow margins should trend above 50% — resulting in over $16 billion in free cash flow to be printed for shareholders throughout 2022.

💰 Current Price: $683 / share

🏦 Bank of America — Vivek Arya: $780 / share

“Reiterate Buy, raise estimates and highlight Broadcom (AVGO) as a top pick within our favored end-market of compute/networking, trading at a compelling below 15x CY23E PE despite industry's most premium portfolio, pricing power, profitability and cash returns.”

⚡️ My Thoughts: Excited

Mature industry leader who has hit critical mass and is printing so much free cash flow for their shareholders that they’re paying a dividend. The growth drivers for the company through the end of the decade are apparent (cloud computing, storage, enterprise, and broadband).

They repurchased about 1% of all outstanding shares in 2021 ($3.1B) with another 3-5% to be retired in 2022 ($7B+). This company also has a massive backlog of deliverables, giving investors a lot of clarity into what revenue will look like in 2023 (assuming they’ll be able to meet demand).

Like most semiconductor companies, supply chain constraints are an issue — but a non-issue in the long-term in my opinion.

Nvidia (NVDA)

NVIDIA is the pioneer of GPU-accelerated computing. The company operates four main business segments — gaming, data center, professional visualization, and automotive. However, the company credits six main themes to drive sustained growth throughout the decade — gaming, artificial intelligence, data center, AI on 5G, autonomous systems, and omniverse.

The company reported their quarterly earnings during mid-February, and they were incredible. Revenue increased +53% to a record $7.6 billion for the quarter. Adjusted EBITDA came in at nearly $4.0 billion (52% margins), and profits came in around $3.3 billion.

Looking forward, the company is expected to generate nearly $35 billion in revenue during 2022 — an increase of +30%, all while maintaining their incredible margins. Free cash flow should land itself around $13 billion for the year.

💰 Current Price: $282 / share

🏦 Bank of America — Vivek Arya: $375 / share

“Our positive view on Nvidia is based on its under-appreciated transformation from a traditional PC graphics chip vendor, into a supplier into high-end gaming, enterprise graphics, cloud, accelerated computing and automotive markets. The company has executed consistently and has a solid balance sheet with demonstrated commitment to capital returns.”

⚡️ My Thoughts: No Brainer

Let’s be real — Nvidia will do $100B in annual revenue by the end of the decade. They’ll also print tens of billions in free cash flow for shareholders in the same period of time. There’s so much to be excited about with this company — sales jump +53% higher during the quarter, they guided to revenue that was $900M higher than initially expected, data center growth is accelerating, operating expenditures remain flat, and they have $20B in cash on their balance sheet.

I’m not sure the upside for this company is derived so much from margin as it is from shear revenue growth. But, assuming all remains the same and growth continues like we think it will, FCF / share is going to continue to skyrocket.

GlobalFoundries (GFS)

This new-to-the-markets semiconductor company provides semiconductor manufacturing services. Their customers include global leaders in the integrated circuit design space. A few names you might recognize include BMW, Ford, and AMD.

The company reported their quarterly earnings results in early-February and they were interesting. Revenue grew +74% to $1.8 billion, with gross profit margins of only 21%, operating margins of only 5%, and profit margins of only 2%. I suppose the good news is there’s plenty of optimization to be had — increasing these margins as the business continues to scale over time.

Looking forward, the company is expected to grow revenue by +18% in 2022 to just about $7.8 billion. Gross profit margins should expand a few hundred basis points in the process — lifting their adj. EBITDA and profits. However, the company likely won’t be free cash flow positive until the end of 2023.

💰 Current Price: $71 / share

🏦 Bank of America — Vivek Arya: $90 / share

“In our view, GFS checks the right boxes of being a US-based outsourced manufacturing (aka foundry) partner for Tier-1 chip designers (Qualcomm, NXP, AMD, ADI, Cirrus, etc.) and auto OEMs (Ford, BMW, Bosch) with proprietary (80% sole sourced) trailing edge processes and long-term ($20bn+) agreements.”

⚡️ My Thoughts: Intrigued

At $70 / share this company is valued ~10X 2023 adj. EBITDA — which in my opinion doesn’t seem too frothy given their long-term potential. This company has clear runway in front of them and can have a material impact on the global capacity for semiconductors in the coming years — this is +5% in 2022 and up to +50% in 2023 (compared to 2020). All of this capacity is backed by long-term customers who have already given GFS >$3B in prepayments.

Their management team has also shown their laser focus on selling toward customers that clearly see their differentiation — allowing them to drive strong pricing power, pushing gross profit margins to the 30% range by 2025.

This company is in the early stages, clearly shown by their negative free cash flow expectations for 2022. Maybe by the end of the decade this could turn into one of those “I got in to GFS when it was only $70 / share — I can’t believe it’s now $300!”

Onsemi (ON)

The company offers three main services — power solutions, advanced solutions, and intelligent sensing. These segments address focus on servicing automotive and industrial end-markets, specifically as it relates to vehicle electrification and safety, sustainable energy grids, industrial automation, and 5G & cloud infrastructure.

Onsemi reported their quarterly earnings in early-February, with revenue increasing +32% to $1.7 billion. A highlight for the quarter were their record gross profit margins — coming in at 45%, compared to 32% in 2020. This catalyzed record operating margins and a +170% increase in free cash flow.

Looking forward, the company is expected to grow their revenue by only about +13% in 2022. Despite the slight revenue bump, adj. EBITDA is slated to grow by +43%, and profits by +42%. Free cash flow should see a meaningful step up as well.

💰 Current Price: $66 / share

🏦 Bank of America — Vivek Arya: $90 / share

“Meanwhile, ON is positioning itself as a leading contender in the emerging Silicon Carbide (SiC) market for EVs (electric vehicles)/industrial applications, which complement its leading position in auto driver assist/industrial image sensors. Capex is rising, as is the case for all semi peers, but ON's top-line growth is a positive offset.”

⚡️ My Thoughts: Intrigued

To me, Onsemi doesn’t seem like your normal “semiconductor play,” but instead a very specialized play on the adoption of EVs at scale. The company is beginning to pivot away from their low-margin (~20%) non-core business opportunities and instead focus on the auto and industrial markets. These two categories make up ~65% of annual revenue.

I’m intrigued by this, but am still skeptical as their management team is expecting to see some meaningful increases in their capital outlays to drive growth over time.

All in All — I’m Excited

Given the immense digital transformation taking place across countless industries — semiconductor stocks as a whole should continue to do well over time. The game plan here to have broad exposure to most, if not all of these, and ride the wave into the 2030s.

It’s incredible to see what a company like Nvidia has done over 10 years’ time (grew revenue from $4B / year to $27B / year) — and I’m excited to see what some of these newer, more specialized companies can do as well.

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

It could be interesting to look at the “shovels” as you like to call them potentially the companies manufacturing the tools used to manufacture semiconductors like daifuku, Lam research, ASML, or ultra clean to name a few.

Hi Austin,

Do you think the VanEck Semiconductor ETF (SMH) is a good buy to diversify into the semiconductor space?