👉 The Investing Week Ahead: 8/22/22

With droughts, doubts, debt bubbles, and a deteriorating housing market... the amount of bad news can't be ignored.

The mad dash to Labor Day Weekend begins.

And the Federal Reserve is getting a head-start on vacationing.

All eyes this week are on the Jackson Hole Economic Symposium, hosted by the Fed Bank of Kansas City. Prominent bankers, policymakers, economists, and business moguls come together for this year’s version of the conference — “Reassessing Constraints on the Economy and Policy.”

The key question at hand: Will Fed Chair Jerome Powell reaffirm his devotion to tackling inflation — regardless of recessionary conditions?

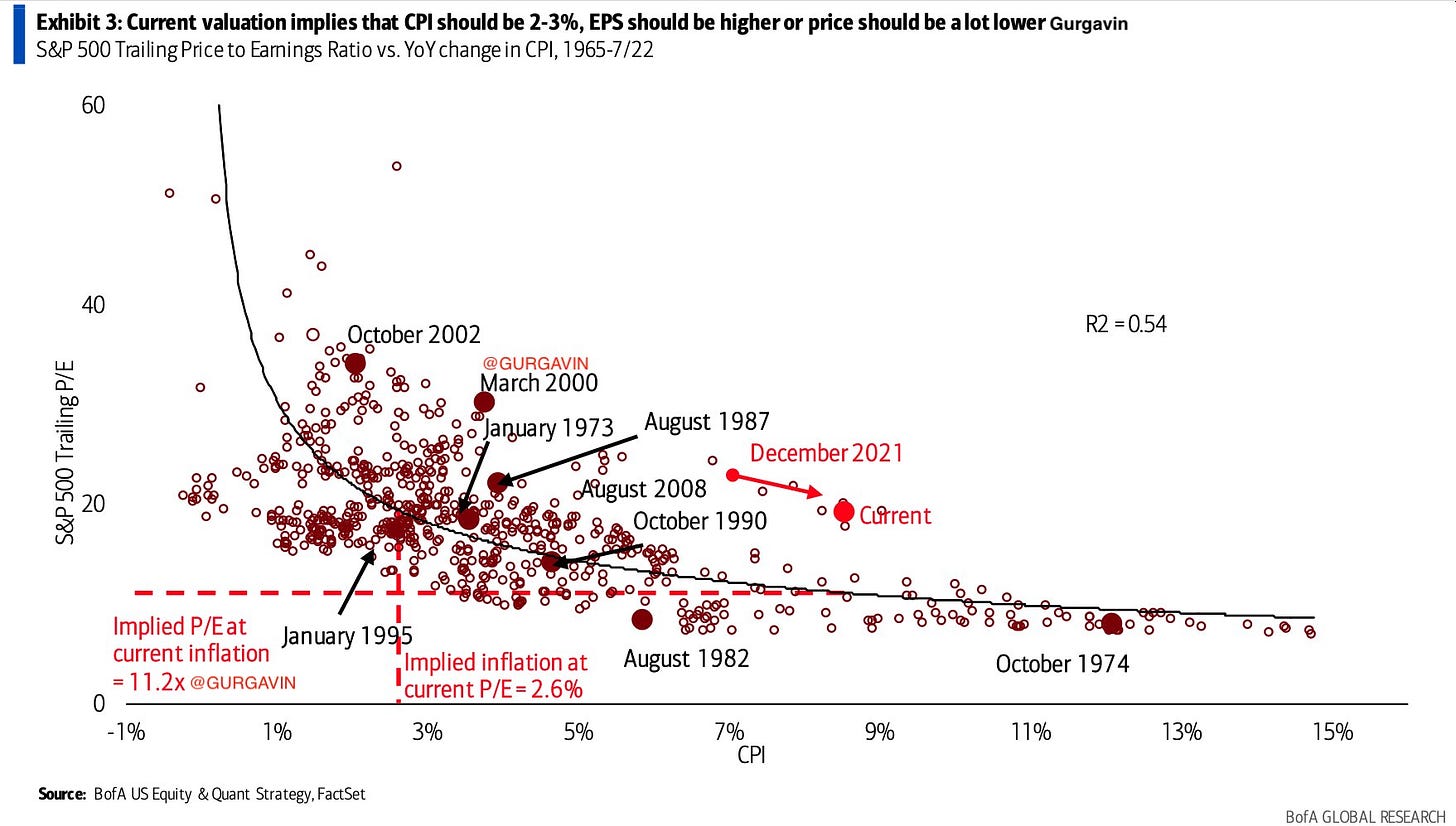

Below is a recent valuation analysis by Bank of America. It suggests that investors are acting as if inflation is ~2.6%. Their findings also suggest that the S&P 500 should be about -50% lower right now based on the massive ignorance of inflationary impacts and staying power.

This isn’t necessarily shocking given the stock market’s forward-thinking attitude, but it does mean that investors could be in for some rude awakenings if inflation can’t be tamed. Personally, I began selling positions into market strength mid-August.

🐻 Charts You Need to See:

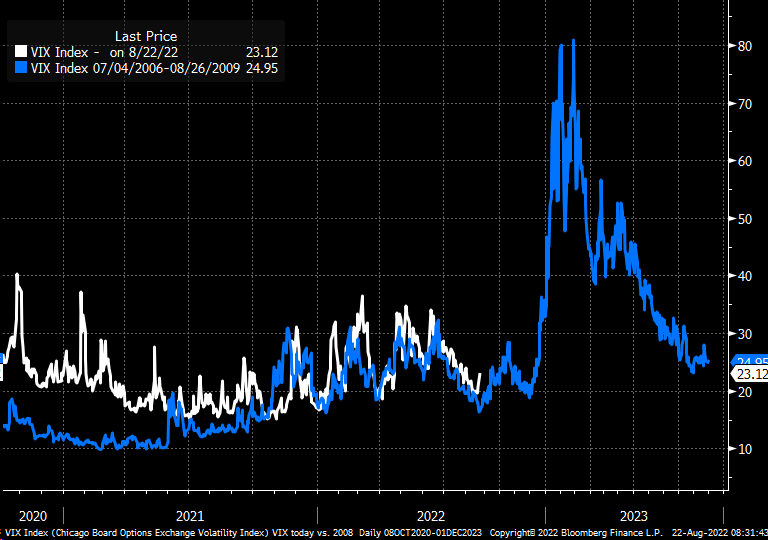

Volatility Index — Today’s Vix vs. 2008’s Vix. Typically, the Vix pushing above 45 during a bear market indicates a “bottom.” This hasn’t exactly happened yet, but we’ll see if this time around is different.

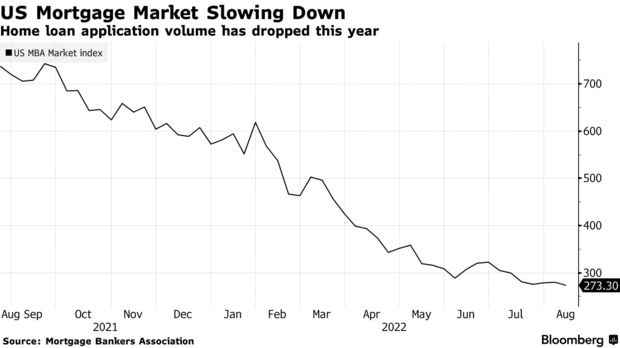

Going Broke — The US mortgage industry is now seeing lenders go out of business after a sudden spike in lending rates. According to Bloomberg, the wave of failures that’s coming could trigger mass layoffs across the country.

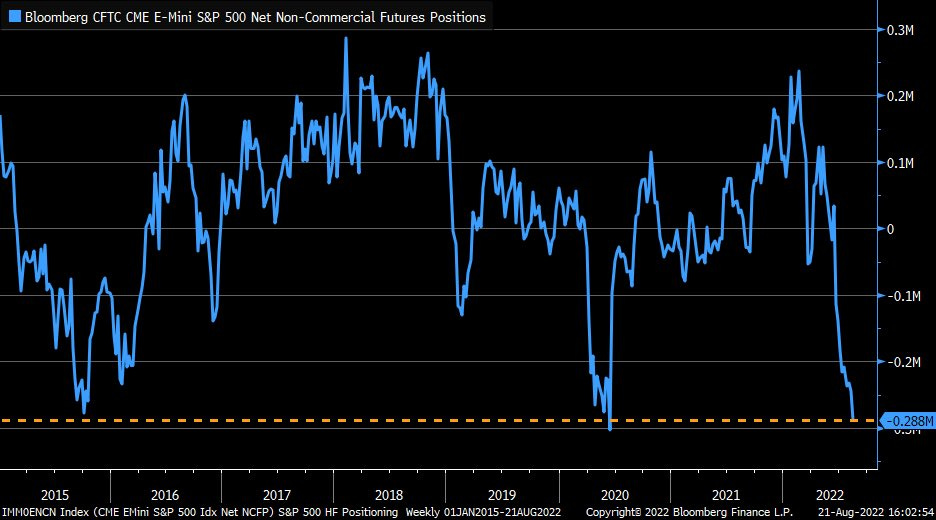

Hedge Funds are Bearish — Net futures positions for the S&P 500 continue to plunge and are near their lowest since June 2020.

The Investing Week Ahead — Too Long, Didn’t Read:

⚡ The last ‘big time’ earnings week of the season, led by Nvidia, Saleforce, & Zoom.

⚡ It’s time for you to pay attention to the drought and energy issues of the world.

⚡ Jackson Hole aside, economic outlooks are updated across the board this week.

Key Earnings Announcements:

As the earnings season crawls toward a close, these major players shouldn’t be overlooked.

Monday (8/22): Palo Alto Networks, Zoom

Tuesday (8/23): Advanced Auto Parts, Dick’s Sporting Goods, Dole, Intuit, JD.com, JM Smucker, La-Z-Boy, Macy’s, Nordstrom, Scotiabank, Urban Outfitters, Xpeng

Wednesday (8/24): Autodesk, Box, Dycom Industries, NVIDIA, Petco, RBC, Salesforce, Snowflake, Splunk, Williams-Sonoma

Thursday (8/25): Abercrombie & Fitch, Affirm, Burlington, Dell, Dollar General, Dollar Tree, Elastic, Gap, Marvell, Peloton, TD Bank, Ulta Beauty, Workday

What We’re Watching:

Palo Alto Networks PANW 0.00%↑ — Some argue that this is one of the world’s best cybersecurity ecosystems. We tend to agree that it’s tracking in that direction. The company’s last report crushed earnings expectations and beat on revenue expectations, bringing in $1.39 billion (+29% YoY). We’ll be paying close attention to their guidance coming out of this week’s report.

Salesforce CRM 0.00%↑ — Marc Benioff's masterpiece has become one of the largest enterprise software companies in the world. As we've seen recently with Amplitude and Monday.com — customers of software companies like Salesforce tend to be sticky and consider their products & services as “strategic advantages.” We’ll be keeping an eye on this one.

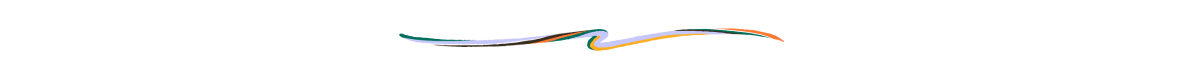

NVIDIA NVDA 0.00%↑ — The key question is if one of the world's rising chip makers has entered a slowdown period. "After Nvidia’s devastating FQ2 earnings sheet, investors have likely not much to expect from Nvidia’s guidance for FQ3 either. The expectation is for $7.0B in revenues for Nvidia’s third fiscal quarter, implying a (2)% growth rate year-over-year. In the last 90 days, there were 20 revenue downward revisions. Considering that Nvidia grew its top line at 46% year-over-year in FQ1, a sequential drop-off in growth rates in FQ3 would strongly indicate that the current expansion cycle has ended.” — The Asian Investor, Seeking Alpha.

Investor Events / Global Affairs

Energy issues, droughts around the world aren’t being talked about enough, and September is typically a bit dicey.

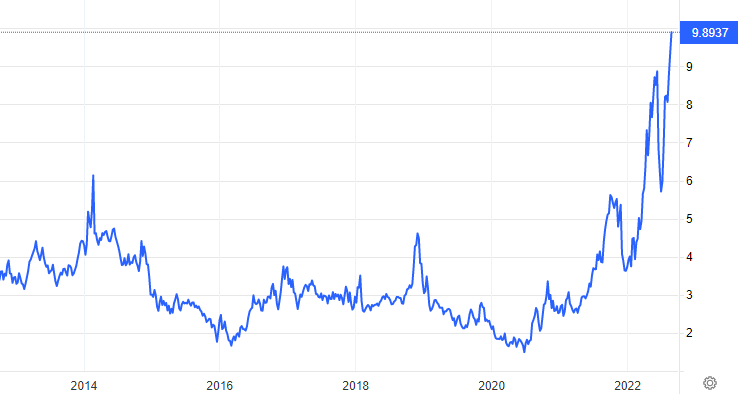

Energy Crisis — Remember how Russia invaded Ukraine, revealing the irresponsible interconnection of energy dependency from countries around the world? Well that sure hasn’t changed.

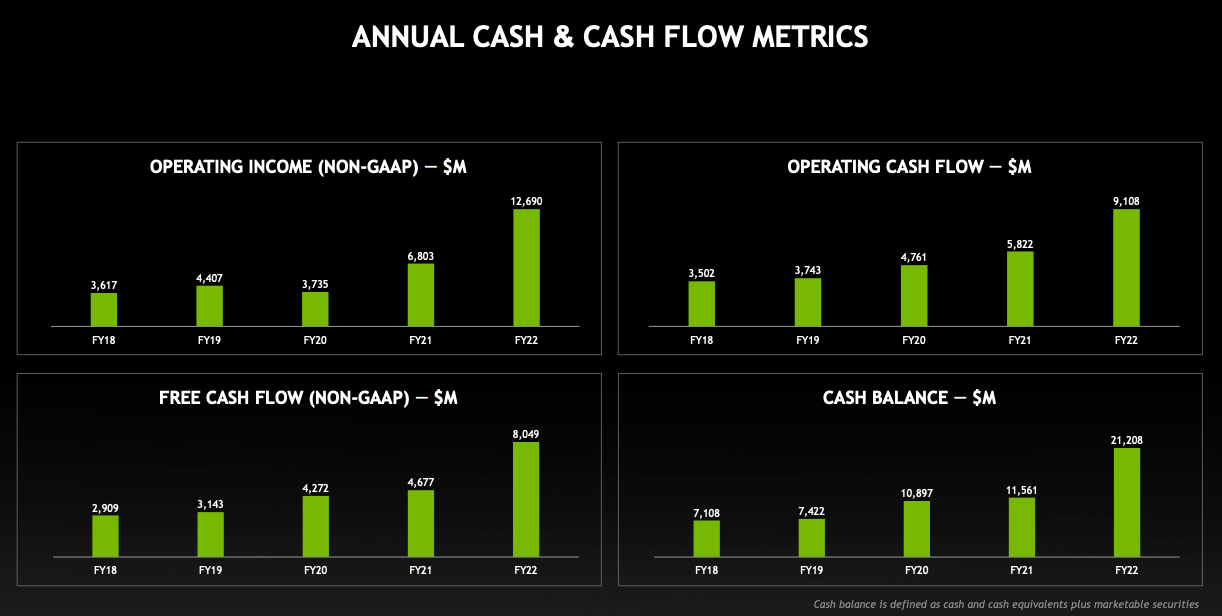

US natural gas prices just hit a 14-year high:

German & French electricity prices are growing at a parabolic pace, which would lead to the vast majority of Europeans not being able to afford electricity if it were to continue as is. German’s benchmark power price is currently at 14x the seasonal average over the past five years:

Tap or Sparkling?: Severe droughts are impacting numerous areas of the world.

China has had to shut down factories and activate its highest emergency response. This impacts many global manufacturers such as Apple, Toyota, and Volkswagen. The longest river in Asia, the Yangtze, is also at its lowest level on record — impacting hydropower and causing mass power shortages. This comes as China reports poor economic data as well.

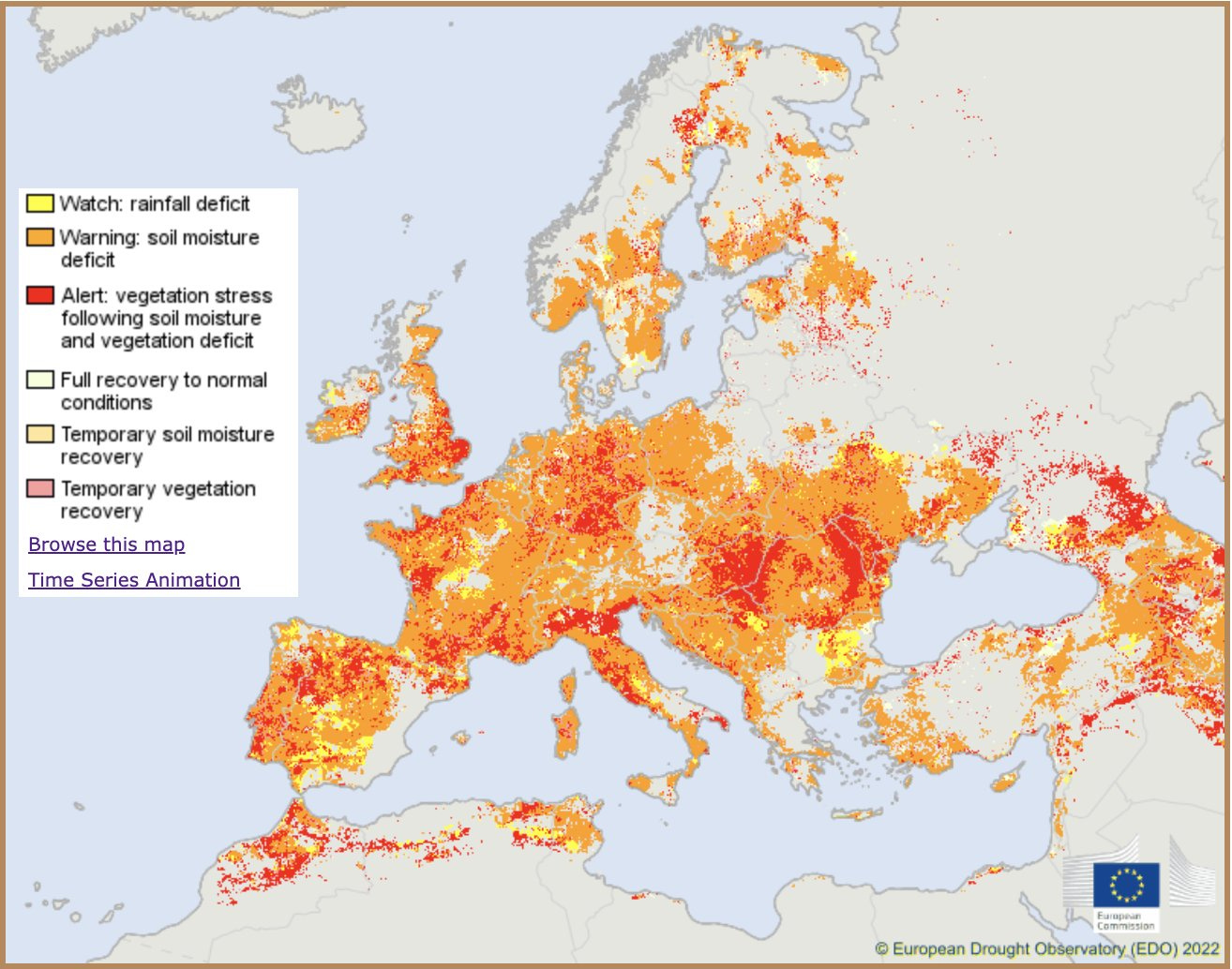

Europe has had its fair share of water issues. Cargo ships on the Rhine River have had to reduce cargo loads due to critically low water levels. Italy has declared a state of emergency along its all-important Po River. 64% of the European Union is experiencing drought warnings:

United States agricultural forecasters now expect farmers to lose 40%+ of their cotton crop, and many farms are being force to leave large portions unplanted due to water shortages. The US Bureau of Reclamation ordered that Arizona and Nevada will have to cut their water allocations by up to 21% next year.

September is Historically Pretty Rough — Investors can’t help but recognize that September is historically a difficult month, and the absolute worst one for the tech sector. Below is chart of the returns of QQQ 0.00%↑:

Major Economic Updates:

As economic worries become more tangible and the company spends more rapidly on EV development, Ford will be laying off 3,000 employees & contract workers (WSJ)

Monday (8/22): Chicago Fed National Activity Index

Tuesday (8/23): New Home Sales, Services PMI

Wednesday (8/24): Durable Goods Orders, Pending Home Sales

Thursday (8/25): Jobless Claims, Q2 GDP (Second Reading)

Friday (8/26): Consumer Sentiment, Consumer Spending, Core & Headline PCE Price Index

What We’re Watching:

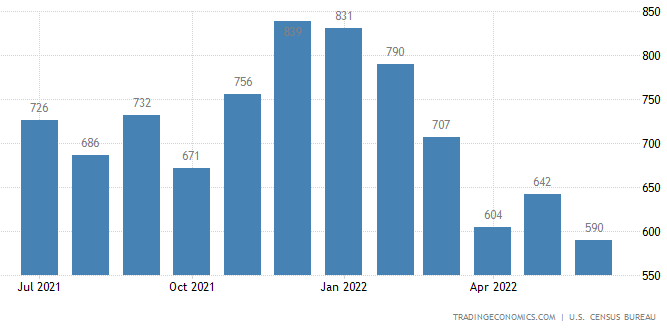

New Home Sales (July)— Continuing to gauge the housing market slowdown across the country.

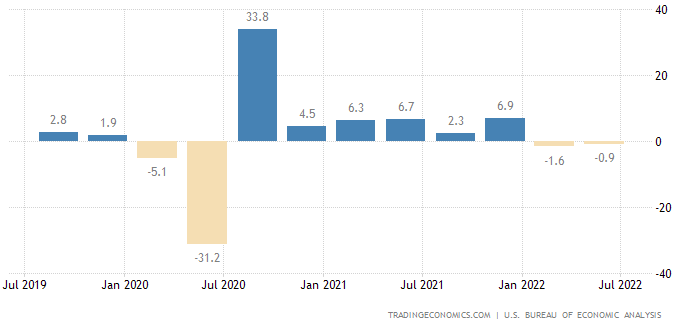

GDP (July, Second Reading) — The key thing to watch is if it gets ‘downwardly revised’. While it’s never as big of a headline as the initial GDP readings, retroactively saying “eh, GDP actually dropped even more than we thought” can send shockwaves through the market.

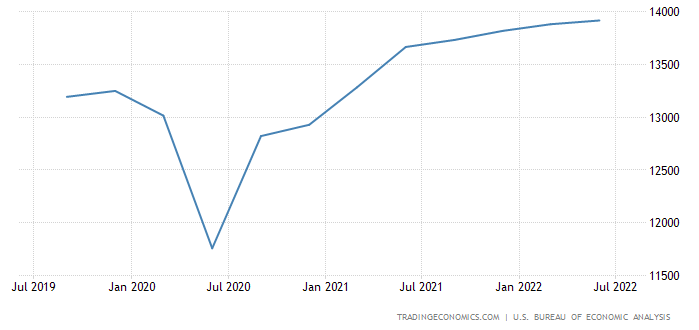

Consumer Spending (July) — We still believe that one of the biggest threats to the US is not short-term decreases in retail sale or overall spending, rather it’s exorbitant spending that is often fueled by credit (debt). We are in the biggest debt bubble of all time right now. We wouldn’t mind seeing this come down for awhile.

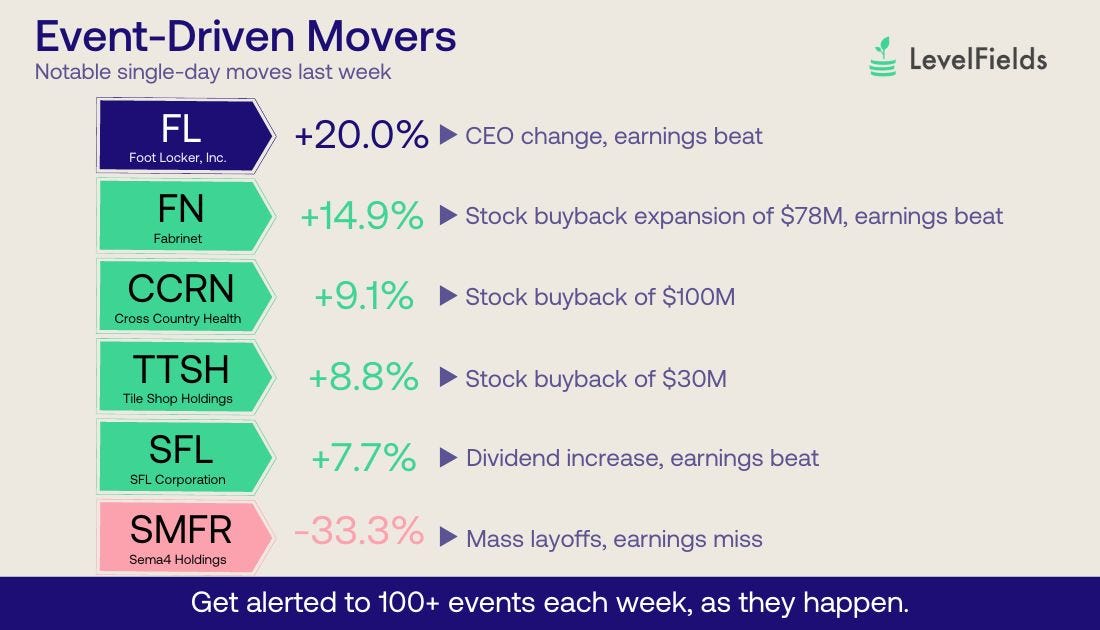

Events-Driven Winners

New meme stock?

Our friends at LevelFields scrub through thousands of data points each week to determine how events impact stock prices.

There’s been some speculation over Foot Locker (FL 0.00%↑) joining the ranks of meme stocks, and LevelFields alerted us that the hype may be real. While we aren’t meme investors, Foot Locker reported better-than-expected earnings and will have their CEO replaced by Mary Dillion — former executive chair & CEO of Ulta Beauty. If you were able to catch this video on Crocs (CROX 0.00%↑).... Foot Locker revealed that sales of the "explosive" shoe company were up +50% YoY last quarter.

If you’re starting your investing journey or want to change to a cleaner, social-focused investing platform, consider visiting Public.com.

Disclaimer: This is not financial advice or recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.